Insurance claims, understanding policy limits is critical for both policyholders and insurers. One essential process that often goes unnoticed but plays a pivotal role in determining claim outcomes is policy limit tracing.

This process helps clarify how much coverage is available, how it should be allocated among claimants, and ensures that insurers meet their obligations without exceeding their risk exposure. This article delves into the concept of tracing, its practical applications, and key insights for stakeholders navigating insurance claims.

Understanding Policy Limits

Before exploring policy limit tracing, it is essential to understand what a policy limit entails. In insurance, the policy limit refers to the maximum amount an insurer will pay under a policy for a covered loss.

Policy limits are designed to manage risk exposure for the insurer while providing a defined level of protection to the policyholder. They can be per occurrence, meaning the maximum payable for a single event, or aggregate, representing the total payable over the policy period.

Policy limits are crucial in cases involving large losses, multiple claimants, or overlapping policies. Misunderstanding policy limits can lead to disputes, undercompensation of claimants, or financial strain on the insurer. This is where policy limits becomes indispensable.

What is Policy Limit Tracing?

Policy limit tracing is the systematic process of tracking, interpreting, and applying insurance policy limits across multiple claims, policies, or coverage periods. It involves identifying which policies are applicable, determining the available limits for specific claims, and establishing the sequence in which limits should be exhausted.

This process is particularly relevant in complex scenarios, such as:

Multiple policies: When a policyholder has coverage under more than one insurance policy (primary and excess coverage), tracing ensures that each policy’s limits are correctly applied.

Multiple claimants: In events where multiple parties are affected, insurers must determine how the available limits are allocated among all claimants.

Overlapping coverage periods: Policies may have overlapping dates, and tracing helps identify which policy responds to a claim first.

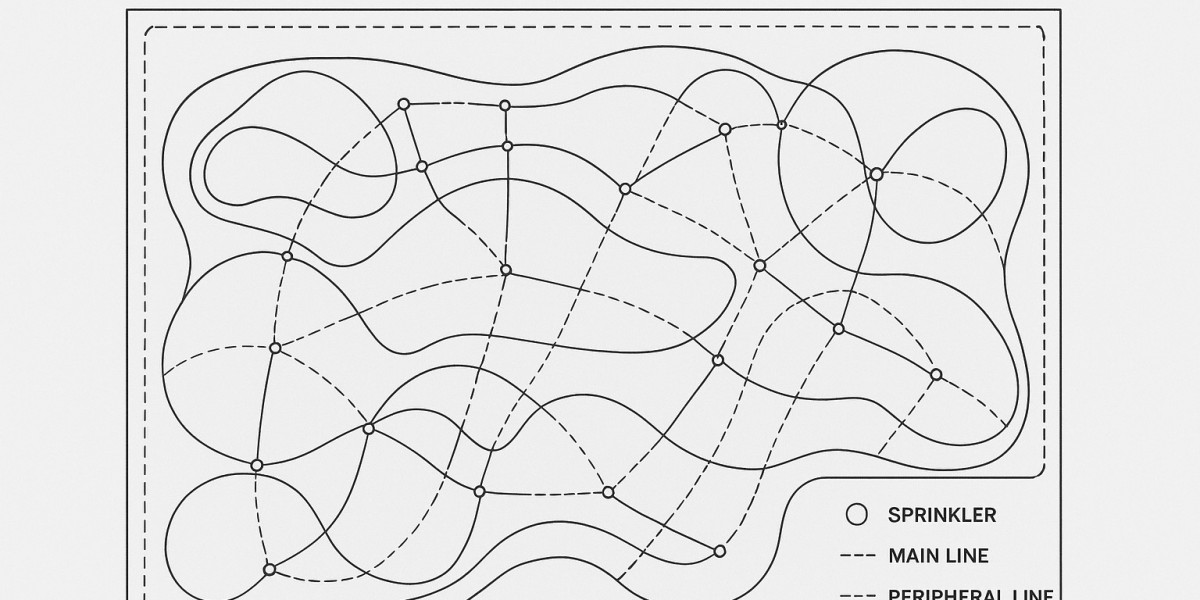

Layered insurance structures: Businesses often have layered policies, where different insurers cover portions of the risk. Tracing ensures that coverage layers are utilized efficiently.

The Importance of Policy Limit Tracing

Policy limits is essential for several reasons:

Accurate Claim Settlement: Tracing ensures that claimants receive compensation up to the maximum available under the relevant policies. It minimizes disputes regarding coverage applicability or limit allocation.

Risk Management for Insurers: Insurers need to avoid paying beyond their contractual limits. Tracing provides a clear understanding of exposure and prevents inadvertent overpayment.

Legal and Regulatory Compliance: In many jurisdictions, insurers are required to adhere to specific rules regarding claims payment and allocation. Proper tracing helps ensure compliance and reduces the risk of litigation.

Transparency and Documentation: Detailed tracing creates an audit trail, allowing both insurers and policyholders to verify how limits were applied. This transparency builds trust and reduces conflicts.

How Policy Limits Works

Policy limits involves several key steps:

Identifying Applicable Policies: The first step is to determine which insurance policies cover the claim. This requires reviewing policy documents, understanding the scope of coverage, and noting any exclusions or special conditions.

Determining Policy Limits: Once applicable policies are identified, the next step is to ascertain the limits. This includes both per-occurrence limits and aggregate limits, as well as any sub-limits that may apply to specific types of losses.

Establishing Priority of Coverage: In cases where multiple policies apply, it is important to determine the order in which policies are exhausted. For instance, primary insurance is typically exhausted before excess or umbrella coverage is triggered.

Allocating Limits Among Claimants: When multiple claimants are involved, insurers must allocate available limits fairly. This can involve prorating payments, considering liability apportionment, or applying contractual obligations.

Documenting the Tracing Process: Detailed records of the tracing process, including communications, calculations, and decisions, are essential for transparency and potential dispute resolution.

Challenges in Policy Limits

Despite its importance, policy limits is not without challenges:

Complex Policy Structures: Large organizations often have multiple layers of insurance with different terms and conditions. Tracing limits in such cases requires meticulous attention to detail.

Ambiguities in Policy Language: Vague or conflicting language in insurance policies can create uncertainty about limit applicability. Legal expertise may be required to resolve disputes.

Multiple Claimants: When several claimants are involved, determining the fair allocation of limits can be contentious, especially if claim amounts exceed the available coverage.

Overlapping Coverage: Policies with overlapping coverage periods can lead to disputes over which policy responds first. Accurate tracing ensures compliance with contractual obligations.

Best Practices for Effective Policy Limits

To manage these challenges, insurers and policyholders should adopt best practices for limit tracing:

Comprehensive Policy Review: Conduct a thorough review of all relevant policies, including endorsements, riders, and amendments, to understand coverage scope and limits.

Maintain Detailed Records: Document all communications, calculations, and decisions related to limit tracing. This provides a clear audit trail and supports dispute resolution.

Use Technology Tools: Modern claims management systems can assist in tracing policy limits across multiple policies and claims, reducing human error and improving efficiency.

Engage Legal and Claims Experts: In complex scenarios, legal and claims professionals can provide guidance on interpreting policy language and determining the correct allocation of limits.

Clear Communication with Claimants: Transparent communication with claimants regarding available limits and allocation procedures reduces the risk of misunderstandings and disputes.

Real-World Applications

Policy limits is commonly applied in industries with high liability exposure, such as construction, healthcare, and transportation. For instance, in a construction defect case involving multiple subcontractors.

Insurers must trace coverage across different policies to ensure proper allocation of limits. Similarly, in healthcare malpractice claims, tracing ensures that payments do not exceed policy limits while compensating multiple injured parties.

Additionally, tracing is vital in cases involving natural disasters, such as hurricanes or floods, where multiple claims arise simultaneously. Proper tracing ensures that all claimants receive fair compensation without exceeding the insurer’s aggregate coverage.

Conclusion

Policy limit tracing is a critical process in the insurance claims ecosystem. By systematically identifying applicable policies, determining limits, and allocating coverage, insurers can settle claims accurately, manage risk effectively, and maintain regulatory compliance.

For policyholders, understanding limit tracing provides clarity on available coverage and expectations during claims. While the process can be complex, adopting best practices, leveraging technology, and seeking expert guidance can ensure that tracing is executed efficiently and transparently.