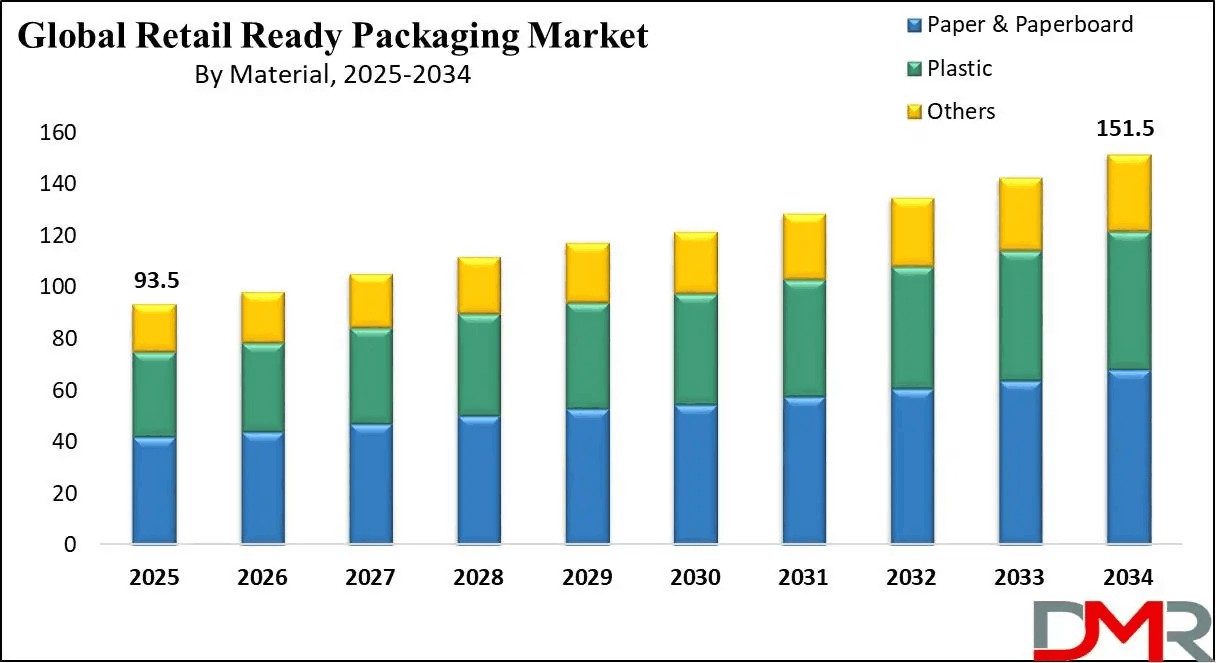

The Global Retail Ready Packaging Market is evolving rapidly as retailers and manufacturers increasingly prioritize efficiency, sustainability, and product visibility. Retail-ready packaging (RRP) allows products to be shipped and displayed directly on shelves without unpacking, reducing labor costs, minimizing handling errors, and enhancing the overall shopping experience. The market is projected to grow from USD 93.5 billion in 2025 to USD 151.5 billion by 2034, at a compound annual growth rate (CAGR) of 5.5% from 2026 to 2034, reflecting its rising importance in global retail strategies.

Market Overview

The Retail Ready Packaging market is expanding due to growing demand for operational efficiency, eco-friendly materials, and visually appealing designs. Retailers are seeking packaging solutions that simplify shelf replenishment, reduce waste, and improve the consumer shopping experience. Increasing adoption of private label products is also driving RRP usage, as brands seek to differentiate themselves with customized packaging that enhances shelf presence.

Digital printing technologies and smart packaging are further boosting market growth by enabling personalized designs, interactive features, and better tracking of products throughout the supply chain. The rise of e-commerce and omnichannel retailing has created a need for packaging that protects products during shipping while remaining attractive on retail shelves, highlighting the versatility of RRP solutions.

Market Dynamics

Drivers

Efficiency and cost reduction remain primary drivers. RRP reduces in-store handling and labor requirements while minimizing damage during transportation. Rising consumer preference for sustainable products is pushing companies to adopt recyclable and biodegradable materials. Furthermore, enhanced brand visibility through innovative packaging designs is encouraging retailers to invest in RRP as a marketing tool that influences purchasing decisions.

Restraints

High initial costs for automated packaging machinery and concerns over the recyclability of some materials can slow adoption. Compliance with environmental regulations also varies by region, adding complexity for global operations.

Opportunities

Smart packaging technologies, including IoT-enabled tracking, interactive labels, and digital printing, present significant opportunities. Growth in emerging markets, particularly in Asia-Pacific and Latin America, offers potential due to rising retail infrastructure, increased disposable income, and growing demand for convenient and sustainable packaging solutions. Companies focusing on eco-friendly materials and innovative designs are well-positioned to capture market share.

Segmentation Analysis

By Material Type: Corrugated cardboard, paperboard, and plastics dominate. Corrugated cardboard is widely used due to its strength, lightweight nature, and recyclability. Plastics are gaining popularity for tamper-evident and flexible packaging, particularly in food and beverage sectors.

By Packaging Type: Tray-based, sleeve-based, and carton-based solutions are common. Tray-based packaging is widely used in bakery, confectionery, and fresh produce, while sleeve-based and carton-based solutions are preferred in beverages, personal care, and consumer electronics for their protective and display qualities.

By End-Use Industry: Food and beverages, personal care, pharmaceuticals, and consumer electronics are major adopters. Food and beverage continues to dominate due to hygiene requirements, high turnover, and the need for effective shelf presentation. Personal care and pharmaceuticals prioritize premium, sustainable, and visually appealing packaging to build consumer trust and loyalty.

By Distribution Channel: Supermarkets and hypermarkets lead due to high-volume operations, while convenience stores, specialty shops, and e-commerce channels are growing rapidly. E-commerce demands packaging that ensures product safety in transit while maintaining brand appeal.

Regional Analysis

North America is expected to dominate the Retail Ready Packaging market with a 36.1% revenue share in 2025, driven by a strong economic foundation and advanced retail infrastructure. Major suppliers such as International Paper Company, Georgia-Pacific LLC, and WestRock Company reinforce the region’s position with innovative and cost-effective solutions. Sustainability initiatives, including collaborations between LVMH and DOW, highlight a growing focus on eco-friendly packaging for cosmetics and perfume brands.

Europe follows closely, with stringent environmental regulations and high adoption of sustainable materials driving growth. Asia-Pacific is emerging as a key growth region due to expanding retail networks, rising disposable income, and increasing demand for convenient and sustainable packaging. Latin America and the Middle East & Africa show steady growth potential as retail infrastructure improves and consumer awareness of eco-friendly packaging rises.

Download a Complimentary PDF Sample Report : https://dimensionmarketresearch.com/report/retail-ready-packaging-market/request-sample/

Competitive Landscape

The market is highly competitive, with both global and regional players focusing on innovation, sustainability, and strategic partnerships. Leading companies invest in R&D to develop eco-friendly materials, automated packaging solutions, and smart packaging technologies. Collaborations with retailers for customized solutions are common, addressing specific operational and branding requirements.

Key Players and Strategies

Major market participants include International Paper Company, WestRock Company, Georgia-Pacific LLC, Smurfit Kappa Group, and DS Smith PLC. These companies are diversifying portfolios to serve multiple industries and integrating digital and IoT-enabled packaging solutions. Regional players focus on providing flexible, cost-effective solutions to small and medium enterprises. Strategic initiatives include mergers, acquisitions, and partnerships aimed at expanding geographic reach and technological capabilities.

Technological Advancements

Digital printing, augmented reality (AR), and IoT integration are transforming RRP. Digital printing allows personalized packaging designs and dynamic messaging. AR-enabled packaging offers interactive consumer experiences, such as product information, promotional content, and loyalty rewards. IoT-enabled RRP facilitates real-time inventory tracking and quality monitoring, optimizing supply chain efficiency. These advancements enhance packaging functionality, improve brand differentiation, and strengthen consumer engagement.

Sustainability Trends

Sustainability is central to RRP growth. Companies are increasingly adopting recycled and recyclable materials, biodegradable plastics, and plant-based packaging. Efforts to minimize material usage and reduce the carbon footprint are becoming standard. Consumer demand for eco-friendly packaging drives innovation, helping brands enhance their market reputation and align with environmental regulations. Lightweight and minimalistic packaging designs also contribute to cost savings in shipping and logistics.

Future Outlook

The Retail Ready Packaging market is expected to experience consistent growth through 2034. Automation in retail operations and technological innovations will continue to drive demand. Expansion in emerging economies, adoption of sustainable materials, and growth of e-commerce will create opportunities for innovative RRP solutions. Companies focusing on efficiency, sustainability, and consumer-centric designs are poised to lead the market. The integration of smart packaging and digital technologies will play a crucial role in enhancing functionality, reducing costs, and improving the shopping experience.

FAQs

What is retail-ready packaging (RRP)?

Retail-ready packaging is designed for direct placement on retail shelves without unpacking, improving operational efficiency and product visibility.

What are the common materials used in RRP?

Corrugated cardboard, paperboard, and plastics are most common, with corrugated cardboard preferred for durability and recyclability.

How does RRP support sustainability?

RRP reduces handling, waste, and transportation costs. Using recyclable and biodegradable materials further enhances environmental benefits.

Which regions lead the RRP market?

North America leads, followed by Europe and Asia-Pacific, driven by advanced infrastructure, technological adoption, and sustainability initiatives.

Which industries use RRP the most?

Food and beverages, personal care, pharmaceuticals, and consumer electronics benefit most from RRP due to operational efficiency, product protection, and enhanced shelf visibility.

Summary of Key Insights

The Retail Ready Packaging market is set to reach USD 151.5 billion by 2034, driven by operational efficiency, sustainability, and consumer engagement. North America remains the leading region, with Europe and Asia-Pacific showing strong growth potential. Market expansion is supported by innovations in smart and sustainable packaging, digital printing, and eco-friendly materials. The market is competitive, with key players focusing on technology, customization, and partnerships. RRP provides retailers and manufacturers with improved efficiency, cost savings, and brand visibility, making it a critical component of modern retail strategies.

Purchase the report for comprehensive details : https://dimensionmarketresearch.com/checkout/retail-ready-packaging-market/