The Global pharmaceutical, healthcare, and personal care industries are undergoing rapid evolution as demand grows for safe, sterile, and highly protective packaging systems. At the forefront of this transformation lies the Ampoules and Blister Packaging Market, a crucial segment that ensures the safety, stability, and integrity of medications, medical devices, diagnostics, and sensitive formulations.

As the need for secure, tamper-proof, and contamination-resistant packaging expands, this market stands as a backbone of global pharmaceutical logistics. With the market expected to experience robust growth through 2033—driven by healthcare infrastructure expansion, rising medicine consumption, and advanced packaging technologies—ampoules and blister packs continue to play an essential role in the worldwide supply chain.

Market Overview

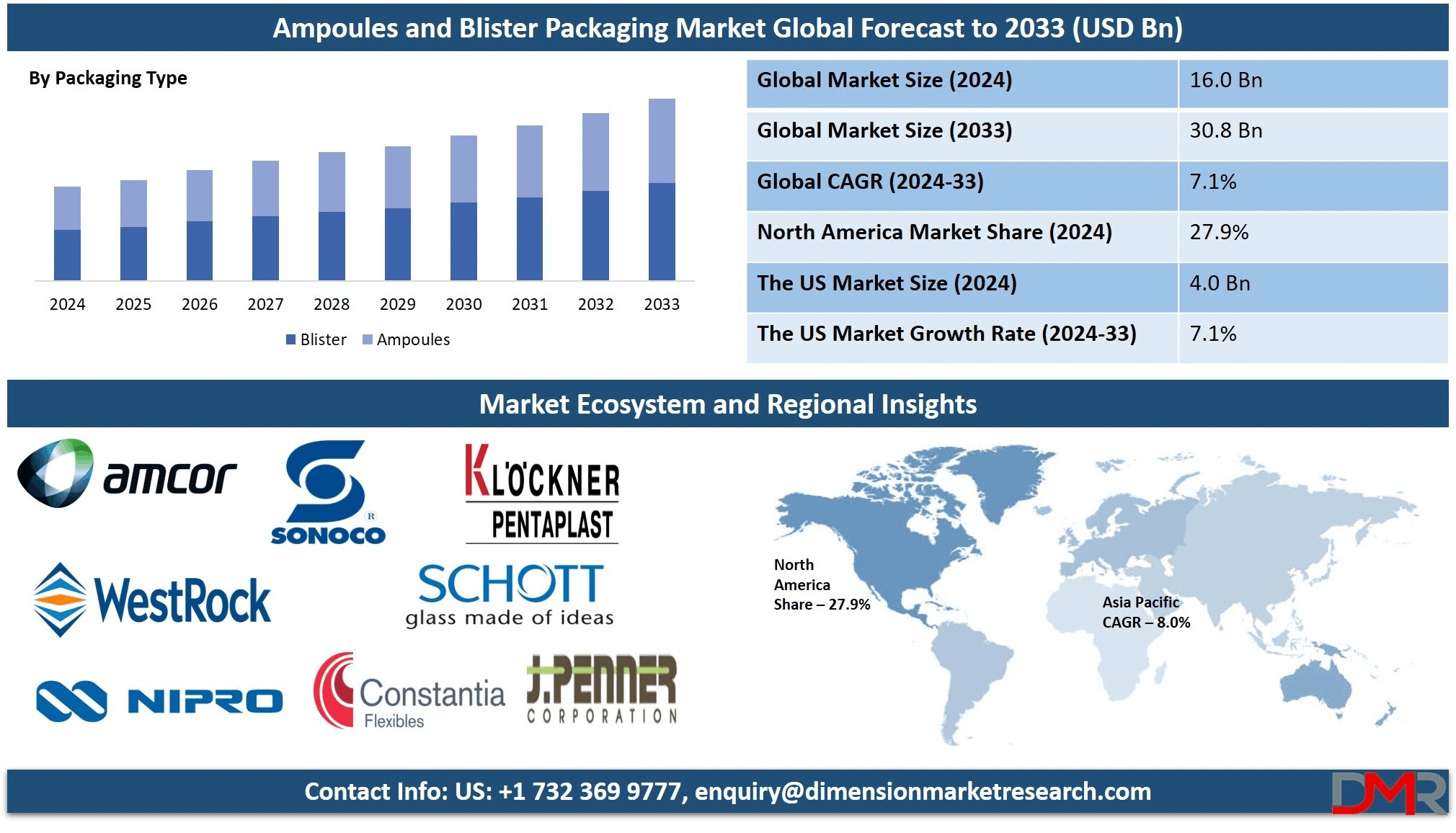

The Ampoules and Blister Packaging Market has seen consistent and sustained growth due to rising pharmaceutical demand, increasing vaccination programs, growing chronic illness prevalence, and a global shift toward unit-dose packaging. Ampoules and blister packs are among the most widely used pharmaceutical packaging solutions due to their sterility, durability, tamper evidence, cost efficiency, and ability to preserve product quality through extended shelf life.

Ampoules—typically made from high-quality glass or specialized plastic polymers—provide hermetically sealed protection for injectable drugs, vaccines, diagnostic reagents, and other sterile preparations. They are essential for products requiring strict protection from moisture, air, and microorganisms. Their transparency, chemical resistance, and compatibility with automated filling systems make them indispensable in modern pharmaceutical production.

Blister packaging is equally vital, especially for solid oral dosage forms such as tablets, capsules, lozenges, and small medical devices like test strips and implants. Blister packs help maintain product stability, protect against contamination, reduce dosing errors, and offer convenient unit-dose dispensing formats. The market benefits significantly from increased global demand for OTC medications, prescription drugs, and nutraceutical supplements.

While the provided dataset mentions the food coating market valuation, the ampoules and blister packaging sector is similarly growing at a strong CAGR attributed to rising healthcare investments, population growth, and infrastructure development. As personalized medicine, self-care routines, and pharmaceutical accessibility increase worldwide, advanced protective packaging solutions have become essential.

Market Dynamics

The growth trajectory of the Ampoules and Blister Packaging Market is shaped by various pharmaceutical, consumer-driven, and technological trends. One of the primary drivers is the rising global prevalence of chronic diseases such as diabetes, cardiovascular disorders, autoimmune conditions, and respiratory illnesses. These conditions require continuous medication, boosting demand for blister packs for oral medicines and ampoules for injectables.

Technological advancements in drug delivery formats are also expanding the market. Vaccines, biologics, biosimilars, and injectable therapeutics often require sterile, contamination-free environments—conditions optimally supported by ampoules. As global immunization efforts intensify, demand for ampoule-based packaging continues to surge.

Convenience-driven consumer behavior is reshaping market demand as well. Blister packaging offers ease of use, portability, and accurate dosage tracking—features highly valued by both patients and healthcare providers. The increasing adoption of home healthcare and self-administered medication further elevates blister packaging usage.

Stringent regulatory frameworks are another market driver. Pharmaceuticals must comply with strict packaging standards for sterility, tamper evidence, labeling, and traceability. Ampoules and blister solutions meet these requirements effectively, supporting compliance and patient safety.

Sustainability trends are influencing the market too. Manufacturers are developing recyclable plastics, eco-friendly blister films, and lightweight materials to reduce environmental impact. Innovations such as plant-based polymers, aluminum-free blisters, and recyclable PET-based blisters reflect the growing market need for sustainable solutions.

However, challenges such as fluctuating raw material prices, complex manufacturing processes, and environmental regulations around plastic usage can affect market profitability. Despite this, rising healthcare expenditure, growing pharmaceutical production, and increasing global awareness about safe medication storage continue to strengthen market expansion.

Segmentation Insights

The Ampoules and Blister Packaging Market can be segmented by material type, product type, application, end user, and packaging format.

By material, glass ampoules dominate due to their chemical stability and inertness. They are widely used for freeze-dried drugs, vaccines, and sensitive formulations. Plastic ampoules—made from polypropylene or PET—are gaining traction due to their affordability, lightweight nature, and reduced breakage risk.

Blister packs use materials such as PVC, PVDC, aluminum foil, thermoformed plastics, cold-formed aluminum composites, and advanced barrier laminates. Cold-formed aluminum blisters offer superior moisture and gas protection, making them ideal for humidity-sensitive drugs. Thermoformed blisters dominate due to lower costs and high production speed.

By product, the market includes straight-stem ampoules, open-funnel ampoules, closed ampoules, and prefilled variants. Blister formats include multi-dose blisters, unit-dose blisters, wallet packs, and specialized medical device blisters.

Applications span pharmaceuticals, nutraceuticals, veterinary medicines, medical devices, diagnostic reagents, and cosmetic serums. Pharmaceuticals account for the largest share due to strict safety standards and high medication consumption rates.

End users include pharmaceutical manufacturers, hospitals, diagnostic laboratories, veterinary clinics, and personal care companies.

Competitive Landscape

The competitive landscape of the Ampoules and Blister Packaging Market is driven by innovation, technological advancement, material science research, and regulatory compliance expertise. Leading manufacturers focus on creating packaging solutions that ensure sterility, high barrier protection, and compatibility with automated filling systems.

Companies are investing in R&D to develop lightweight ampoules, enhanced barrier blister films, eco-friendly materials, and integrated traceability features such as QR-based tracking and tamper-evident seals. Digitalization of packaging lines using IoT-enabled machinery and AI-based inspection systems enhances quality control and reduces manufacturing errors.

Strategic collaborations between pharmaceutical companies, packaging suppliers, and contract manufacturers help accelerate product development and innovation. Many companies are expanding production capacity in Asia-Pacific and Europe to meet rising global demand.

Cosmetic and personal care brands are emerging as important customers as they increasingly use ampoules for skincare concentrates, vitamin serums, and anti-aging treatments—further strengthening the market’s diversification.

Regional Analysis

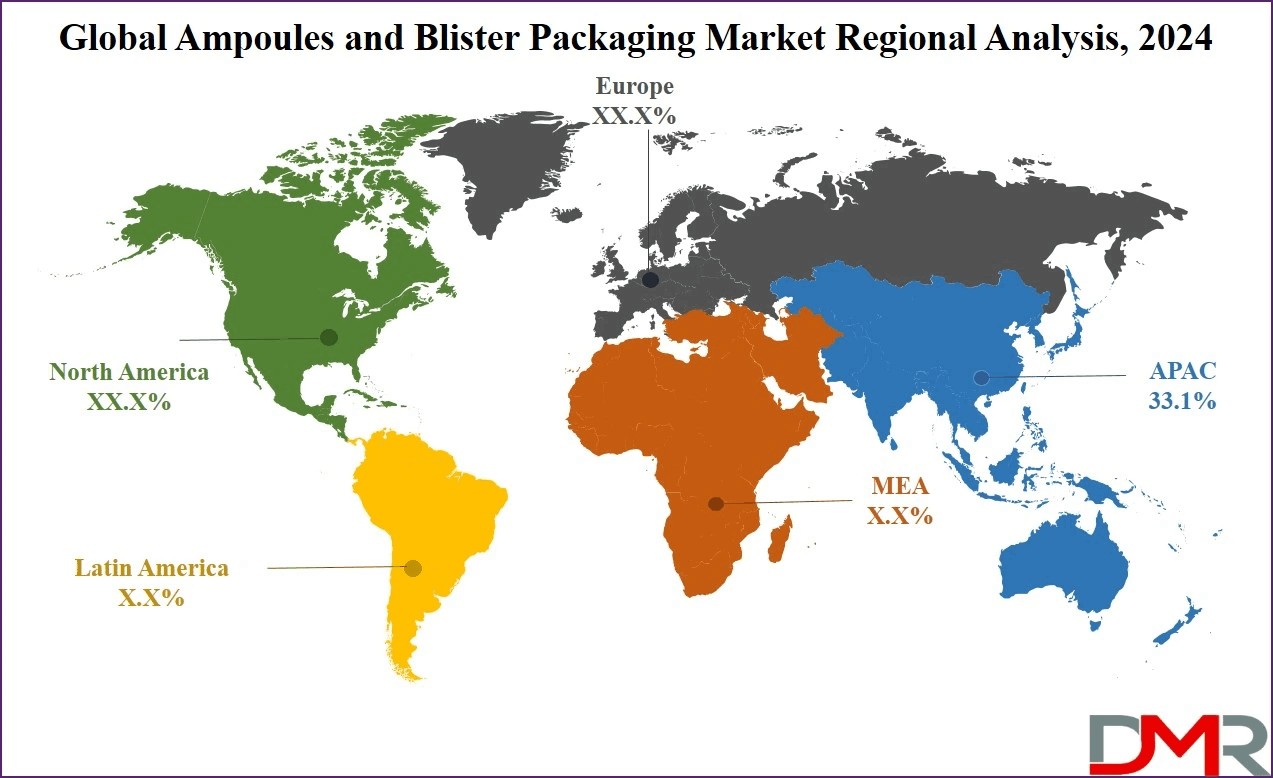

The Asia-Pacific region dominates the Ampoules and Blister Packaging Market, holding a significant 33.1% share as of 2024. This leadership position is supported by rapid population growth, rising healthcare expenditure, and increasing pharmaceutical production across China, India, Japan, and Southeast Asia.

China remains the largest user in the region due to its expansive pharmaceutical manufacturing base, growing disease prevalence, and cost-effective labor and machinery. The country produces massive volumes of blister packs and ampoules used for domestic consumption and global export.

India is experiencing rapid expansion propelled by its strong generic drug industry, rising vaccination programs, and ongoing investments in pharmaceutical infrastructure. Indian manufacturers are increasingly adopting high-speed blister lines and glass ampoule production technologies to supply both domestic and global markets.

Japan and South Korea emphasize high-quality packaging with strict regulatory compliance. Their advanced manufacturing technologies, precision engineering capabilities, and focus on premium pharmaceutical and cosmetic markets contribute to strong regional growth.

Southeast Asian countries, including Indonesia, Vietnam, and Thailand, are witnessing rising adoption of blister packaging driven by increasing access to healthcare services and expanding over-the-counter medication markets.

Download a Complimentary PDF Sample Report :

https://dimensionmarketresearch.com/report/ampoules-and-blister-packaging-market/request-sample/

Applications and Industry Adoption Trends

Ampoules and blister packaging have widespread applications across various healthcare and consumer product categories. In pharmaceuticals, blister packs are used extensively for tablets and capsules due to their ability to protect drugs from moisture, light, and contamination. They also support accurate dosing, reduce wastage, and improve patient adherence by organizing medication into daily or weekly formats.

In injectable drugs, ampoules remain the gold standard for sterile packaging. These sealed glass or polymer containers protect liquid and lyophilized drugs from contamination and maintain chemical stability. They are widely used for vaccines, analgesics, antibiotics, vitamins, and diagnostic reagents.

Nutraceuticals and dietary supplements rely heavily on blister packs due to their convenience and extended shelf life. Cosmetics and dermatological products increasingly use ampoules for concentrated serums, skin rejuvenation formulas, and vitamin blends.

The diagnostics sector uses blister packs and ampoules for test kits, reagents, and single-dose medical device components. Veterinary medicine, which requires portable and robust packaging formats, also drives adoption.

Sustainability and digitization have become major trends. Manufacturers are adopting recyclable blister materials, aluminum-free options, biodegradable plastics, and paper-based blisters to reduce environmental impact. Smart packaging solutions featuring batch-tracking codes, tamper-evident seals, and interactive labels support product authentication and supply chain transparency.

Technology Advancements and Future Outlook

Technological advancements in the Ampoules and Blister Packaging Market are rapidly transforming manufacturing efficiency, product safety, material performance, and automation capabilities. High-speed filling and sealing machines, robotics, AI-enabled inspection systems, and laser coding technologies have improved production accuracy and reduced contamination risks.

Material science innovations are creating new, advanced blister films with enhanced moisture, oxygen, and UV barrier properties. Recyclable PET-based blisters, pharmaceutical-grade biodegradable polymers, and eco-friendly laminates are gaining market traction.

Smart packaging integrations—such as RFID tags, QR tracking, temperature-sensitive indicators, and anti-counterfeiting markers—are becoming common, especially in high-value medications and medical devices.

The future of the market will be heavily influenced by sustainability standards, digital supply chain systems, automation adoption, and demand for personalized medicine packaging. As global healthcare infrastructure continues to expand, ampoules and blister packaging will remain essential for safe, reliable, and efficient product delivery.

FAQs

Q1: What is driving growth in the Ampoules and Blister Packaging Market?

A1: Growth is driven by rising pharmaceutical demand, increasing chronic disease prevalence, expanding vaccination programs, and the shift toward safe, unit-dose medication packaging.

Q2: Which region leads the global market?

A2: The Asia-Pacific region leads with a 33.1% share due to population growth, expanding healthcare access, and increased pharmaceutical manufacturing.

Q3: What materials are commonly used in ampoules and blister packaging?

A3: Common materials include glass, polypropylene, PET, PVC, PVDC, aluminum foil, and multi-layer barrier films.

Q4: Why are blister packs preferred for oral medicines?

A4: Blister packs offer superior moisture protection, contamination resistance, accurate dosing, portability, and extended shelf life.

Q5: What trends are shaping the future of this market?

A5: Key trends include sustainable materials, smart packaging technologies, automation, traceability systems, and personalized medicine packaging.

Summary of Key Insights

The Ampoules and Blister Packaging Market continues to grow as global healthcare demand evolves, pharmaceutical production increases, and safety standards rise. Asia-Pacific leads global adoption due to strong infrastructure, growing populations, and expanding medicine consumption. Technological advancements, sustainability initiatives, and the shift toward smart packaging will continue to shape the market's future. With strong demand across pharmaceuticals, diagnostics, cosmetics, and nutraceuticals, the market remains poised for long-term expansion.

Purchase the report for comprehensive details :

https://dimensionmarketresearch.com/checkout/ampoules-and-blister-packaging-market/