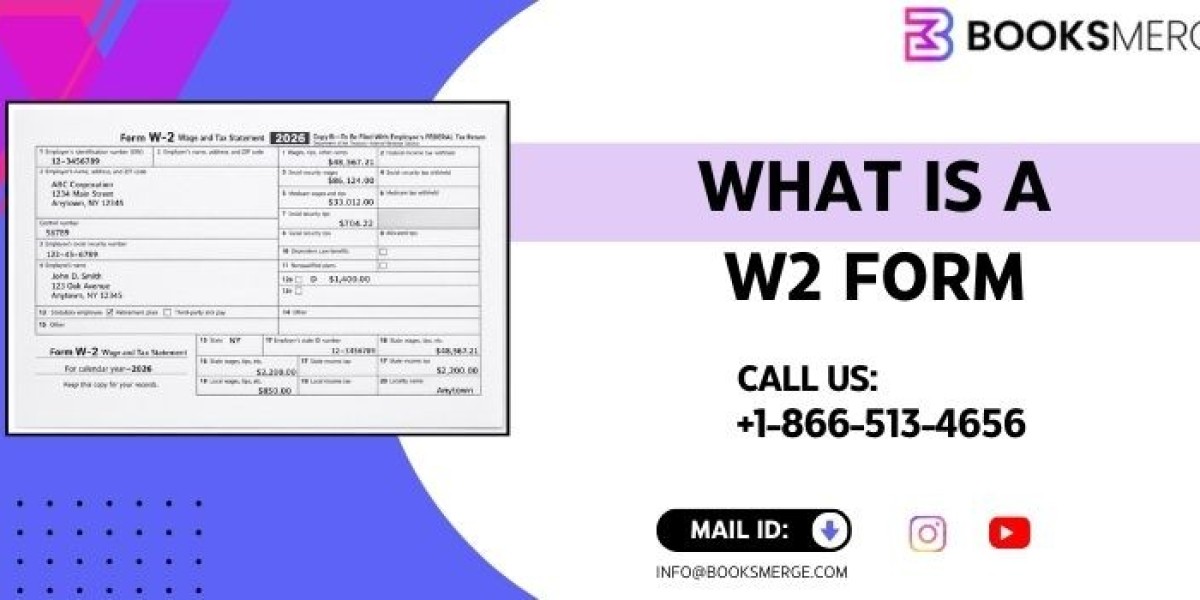

A W-2 form is a tax document that reports an employee’s annual wages and the taxes withheld, helping individuals file federal and state tax returns accurately.

Filing taxes can be stressful, but understanding what a W2 form is makes the process easier. BooksMerge helps employees and employers navigate W-2 requirements efficiently—call +1-866-513-4656 for expert assistance.

Table of Contents

- What Is a W-2 Form Used For

- Purpose of a W-2 Form

- W-2 Form vs W-4 Form

- How Employees Receive a W-2

- How Employers File W-2 Forms

- Key Sections of a W-2 Form

- Deadlines and Timing

- Common Mistakes to Avoid

- W-2 Form and Tax Filing

- Tax Price for Professional Filing

- Why BooksMerge Can Help

- Conclusion

- FAQs

What Is a W-2 Form Used For?

The W-2 form shows an employee’s total earnings and the federal, state, and local taxes withheld for the year.

It is essential for filing federal and state income tax returns accurately. Without a W-2, employees cannot report wages or calculate refunds and taxes owed. In short, what is a W2 form becomes clear: it is used for reporting taxable income to the IRS and ensuring compliance.

Purpose of a W-2 Form

The main purposes of a W-2 form include:

- Reporting wages and salary to the IRS

- Showing the total federal, state, and local taxes withheld

- Supporting Social Security and Medicare contributions

- Helping employees claim refunds or pay owed taxes

Think of it as the official paycheck summary that the IRS relies on. Knowing what is the purpose of a W2 form prevents filing errors and penalties.

W-2 Form vs W-4 Form

Many people confuse W-2 and W-4 forms. Here’s the difference:

- W-2 Form: Reports wages and tax withholding from the previous year.

- W-4 Form: Tells employers how much tax to withhold from each paycheck.

Understanding the difference ensures accurate reporting and avoids over- or underpaying taxes.

How Employees Receive a W-2

Employers must provide W-2 forms to employees by January 31 each year. Employees receive it either:

- Physically, as a mailed paper form

- Electronically, through a secure portal

Employees should keep their W-2 forms safe for tax filing. Missing forms can delay refunds and cause headaches with the IRS.

How Employers File W-2 Forms

Employers report W-2 information to:

- The IRS (federal)

- State tax agencies

- Social Security Administration (SSA)

Filing can be done electronically or via paper forms. Employers must submit accurate W-2s to avoid penalties. If mistakes occur, corrected forms (W-2c) must be issued.

Quick Tip: An IRS form list is a complete collection of official tax forms used by individuals and businesses to report income, claim credits, and comply with federal tax requirements.

Key Sections of a W-2 Form

A W-2 form includes multiple important sections:

- Employee Information: Name, address, Social Security number

- Employer Information: Name, address, Employer Identification Number (EIN)

- Wages and Tips: Total taxable income for the year

- Federal Income Tax Withheld

- Social Security and Medicare Contributions

- State and Local Taxes Withheld

Knowing these sections helps employees verify their income and taxes before filing returns.

Deadlines and Timing

Key deadlines for W-2 forms include:

- January 31: Employers must send W-2s to employees

- January 31: Employers file W-2s with the SSA

- April 15: Employees file their income tax returns using the W-2

Missing deadlines can trigger fines for employers and delay refunds for employees.

Common Mistakes to Avoid

Errors in W-2 forms are common. Watch out for:

- Incorrect Social Security numbers

- Wrong employer EIN

- Misreported wages or tips

- Missing boxes for federal, state, or local taxes

Double-checking W-2 forms prevents headaches and IRS penalties.

W-2 Form and Tax Filing

The W-2 form is the foundation of your tax return. Employees use it to fill Form 1040 and calculate:

- Federal income taxes owed or refunded

- State and local income taxes

- Social Security and Medicare contributions

Having a W-2 ensures accurate filing and prevents delays.

Tax Price for Professional Filing

Some employees and small business owners hire professionals for W-2 filing. BooksMerge provides transparent tax price services, ensuring:

- Accurate preparation and filing

- Maximum allowable refunds

- Compliance with IRS deadlines

Call +1-866-513-4656 for a quote and assistance. Clear pricing avoids surprises and ensures professional support.

Why BooksMerge Can Help

BooksMerge offers expert accounting, bookkeeping, and taxation services. For W-2 forms, we:

- Ensure all wages and withholding are reported correctly

- Assist both employees and employers with filing

- Help with corrections if forms are wrong

- Provide guidance on tax reporting and compliance

With our help, W-2 forms are simple and stress-free.

Conclusion

Understanding what a W-2 form is and its purpose is crucial for every employee and employer. From reporting wages to calculating taxes, the W-2 ensures accurate income reporting and compliance with the IRS.

Following deadlines, checking details, and seeking professional help from BooksMerge saves time, prevents errors, and ensures peace of mind. Call +1-866-513-4656 for expert assistance today.

Frequently Asked Questions (FAQs)

What is a W2 form?

A W-2 form reports an employee’s annual wages and taxes withheld for filing federal and state tax returns.

What is a W2 tax form?

It is the official tax document that summarizes wages, tips, and deductions required for accurate tax filing.

What is the purpose of a W2 form?

The purpose is to report income, taxes withheld, and support Social Security, Medicare, and accurate tax returns.

What is a W2 form used for?

It is used to file federal and state tax returns and verify income with the IRS.

What is a W2 form for?

It serves as an official record of wages, tips, and tax withholdings for the tax year.

Read Also: How to fill out a 1040 form