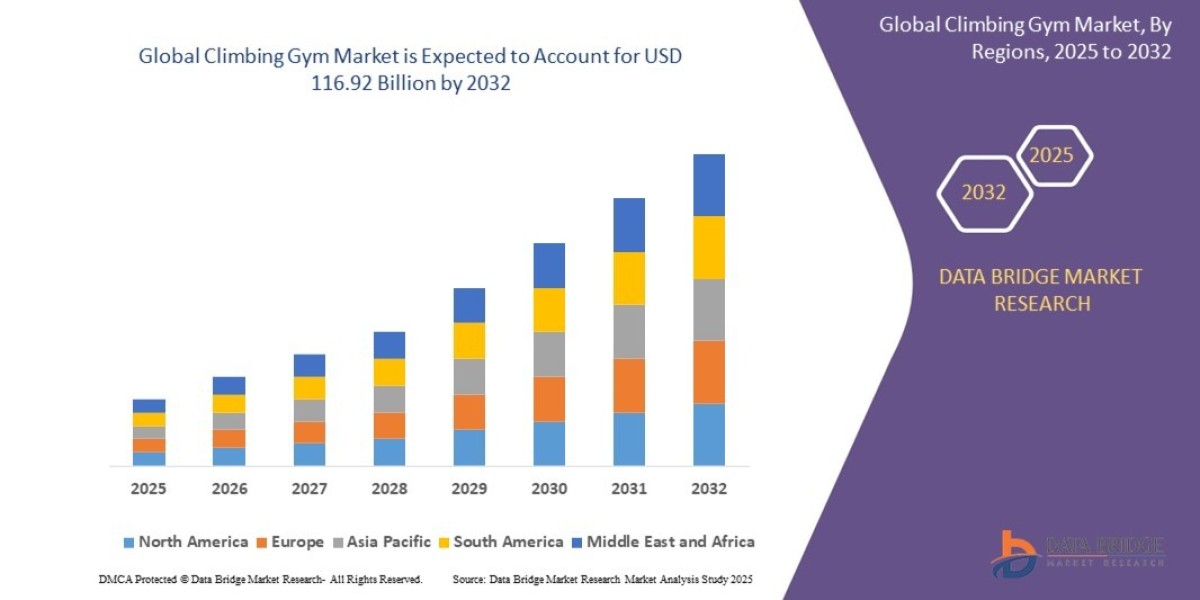

Market Overview

The GCC Ice Cream Market size was USD 1.8 Million in 2024 and is expected to reach USD 3.3 Million by 2033. The market is projected to grow at a CAGR of 6.1% during the forecast period of 2025-2033. This growth is fueled by rising disposable incomes, shifting preferences toward indulgent and healthier products, innovation in flavors and formats, expansion of retail channels, and climate-driven demand.

How AI is Reshaping the Future of GCC Ice Cream Market

- AI-driven consumer insights enable manufacturers to innovate unique flavors tailored to local tastes, enhancing product acceptance.

- Advanced AI systems optimize supply chain management, reducing wastage in perishable products like ice cream, improving profitability.

- AI-powered e-commerce platforms provide personalized shopping experiences, boosting online sales of ice cream across GCC.

- Predictive analytics powered by AI assist companies in forecasting demand fluctuations related to temperature changes, aiding inventory planning.

- AI facilitates quality control by automating ingredient consistency checks, ensuring premium product standards in artisanal ice cream.

- Collaborative AI-driven marketing campaigns leverage social media influencers and local data to effectively promote healthier and premium ice cream options.

Grab a sample PDF of this report: https://www.imarcgroup.com/gcc-ice-cream-market/requestsample

Market Growth Factors

The most important market growth driver is considered to be disposable income, particularly since the GCC region's states have high levels of disposable income available for spending on indulgent items such as ice cream. This has led to growth in demand for both standard and premium or artisanal ice cream. The increasing temperature, demand for chilled products, the increase in the number of supermarkets and hypermarkets, convenience store chain stores, and other e-commerce channels in the region are the factors driving the growth of the market. The launch of new flavors in the healthy products as per the changing taste of the consumer is also driving the market.

Health consciousness has greatly affected ice cream manufacturers and distributors in the GCC region. The United Arab Emirates' Ministry of Health and Prevention has said that people increasingly demand ice creams that have low-fat and that are sugar-free because they become aware of obesity and diabetes in the population. In addition to the purely vegan manufacturers larger companies such as Almarai and Nestl are producing their own dairy and gluten free ice creams. The health and wellness segment of the ice cream market in the MENA region is growing at a CAGR of 15%. Saudi Arabia is a large market. Retailers have given space to the health claims as a marketing device to a consumer base seeking healthy products.

Also part of the premiumization and artisanal trend, the Gulf Cooperation Council's latest report on the GCC Food and Beverage Sector states that premium ice cream has grown by 8% annually in recent years, as consumers are willing to pay for better, higher-quality ingredients, specialty shops are dominant, chains like Baskin-Robbins and Froneri are creating premium products, social media promotes a premium image, and regional or customary varieties cater to local tastes. In addition, because consumers are becoming more affluent, the demand for luxury or gourmet foods may increase the market for premium foods.

Market Segmentation

Breakup by Flavor:

- Chocolate

- Fruit

- Vanilla

- Others

Breakup by Category:

- Impulse Ice Cream

- Take-Home Ice Cream

- Artisanal Ice Cream

Breakup by Product:

- Cup

- Stick

- Cone

- Brick

- Tub

- Others

Breakup by Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Ice Cream Parlours

- Online Stores

- Others

Breakup by Country:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent Developement & News

- June 2025: The UAE government partnered with educational institutions to promote nutrition awareness linked to dairy and frozen dessert consumption, supporting healthier ice cream product development and increasing consumer awareness on low-fat and sugar-free options.

- August 2025: House of Pop, a Dubai-based ice cream brand, announced expansion in the GCC through franchising and distribution partnerships, targeting Saudi Arabia and Bahrain for increased market penetration of healthier frozen desserts.

- September 2025: E-commerce channels registered a doubling in ice cream sales, backed by investments from major companies including Unilever and Mars, Inc., indicating a significant shift toward online platforms for ice cream purchases.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302