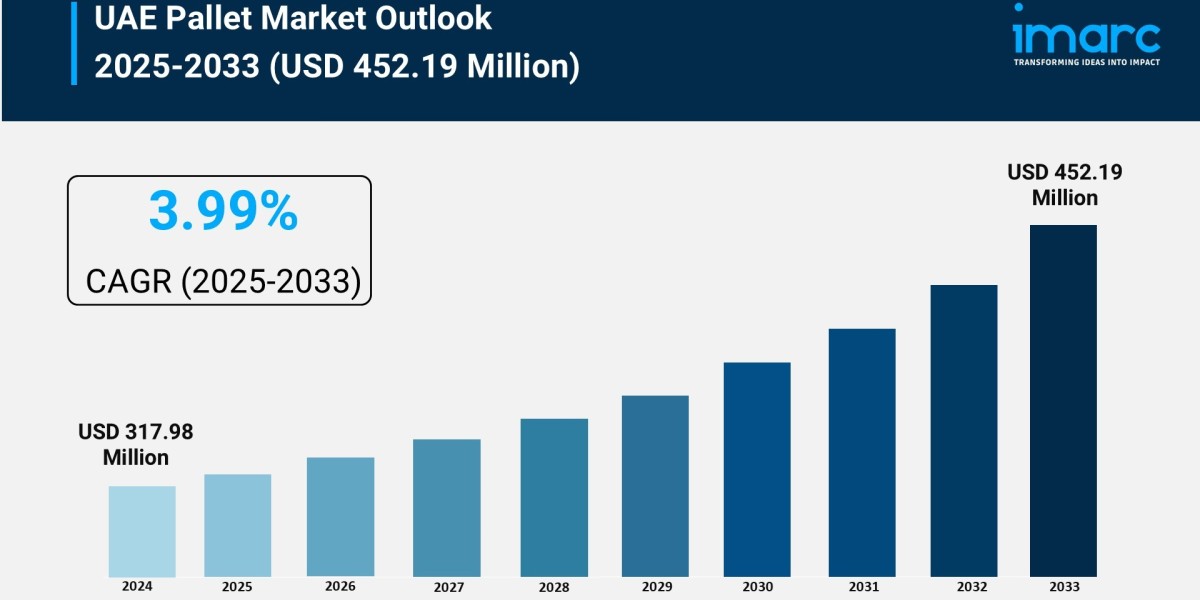

UAE Pallet Market Overview

Market Size in 2024: USD 317.98 Million

Market Size in 2033: USD 452.19 Million

Market Growth Rate 2025-2033: 3.99%

According to IMARC Group's latest research publication, "UAE Pallet Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The UAE pallet market size was valued at USD 317.98 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 452.19 Million by 2033, exhibiting a CAGR of 3.99% during 2025-2033.

How AI is Reshaping the Future of UAE Pallet Market

- Revolutionizing Predictive Maintenance: AI algorithms analyze sensor data from smart pallets to predict wear patterns and maintenance needs, reducing unexpected failures by up to 30% and extending pallet lifecycles across UAE's automated warehouses.

- Optimizing Supply Chain Visibility: Machine learning systems process real-time data from RFID and IoT-enabled pallets, providing granular insights on location, temperature, shock, and inventory levels that enhance tracking accuracy and reduce asset loss throughout complex distribution networks.

- Enhancing Automated Warehouse Operations: AI-powered systems at facilities like DP World's Jebel Ali Port coordinate robotic forklifts and automated storage systems with smart pallets, improving handling efficiency and reducing operational downtime in high-volume logistics centers.

- Driving Sustainable Material Selection: AI models analyze lifecycle data, cost factors, and environmental impact to help companies choose optimal pallet materials—whether recycled plastic, certified wood, or metal—aligning with UAE Net Zero 2050 commitments while maintaining operational efficiency.

- Accelerating Pallet Pooling Optimization: Artificial intelligence predicts demand patterns and optimizes pallet circulation routes, enabling pooling services to reduce waste and improve asset utilization rates by matching available pallets with real-time logistics needs across the Emirates.

Grab a sample PDF of this report: https://www.imarcgroup.com/uae-pallet-market/requestsample

UAE Pallet Market Trends & Drivers:

The UAE's ambitious sustainability agenda is fundamentally reshaping pallet choices across industries. With UAE Net Zero 2050 and Dubai Industrial Strategy 2030 pushing companies toward greener operations, businesses are moving away from traditional wooden pallets to eco-friendly alternatives. Recycled plastic pallets are gaining serious momentum despite higher upfront costs, as their durability, hygiene, and longer lifespans deliver better lifecycle economics. Companies with FSC or PEFC certified wood pallets are also seeing increased demand as corporate ESG commitments intensify. The UAE banking sector's strength—with assets growing to AED 4.6 Trillion (USD 1.251 Trillion) and retail credit jumping 16.8%—is providing solid financial infrastructure for businesses to invest in sustainable pallet solutions. Pallet pooling services are taking off as they drastically cut single-use waste and optimize asset utilization. Regulatory standards from Emirates Authority for Standardisation & Metrology, combined with customer pressure for greener supply chains, are making sustainable pallets a core logistics consideration rather than an optional upgrade.

The UAE's transformation into a global logistics powerhouse is creating unprecedented demand for advanced pallet technology. Dubai's Silk Road Strategy and massive automation projects at Jebel Ali Port—which now handles 19.4 million TEU capacity across over 100 berths—are driving the need for pallets that work seamlessly with robotic systems. Automated material handling equipment like AGVs, AMRs, and AS/RS systems require pallets with exceptional dimensional consistency and structural rigidity for reliable performance. DP World's recent expansion at Jebel Ali Terminal 4, adding 13,000 car equivalent units and 2.6 million square feet of space, highlights the scale of infrastructure growth. Americold's new flagship hub at Jebel Ali Free Zone offers 40,000 pallet positions with multi-temperature capabilities, demonstrating how specialized logistics facilities are expanding. The shift toward electric freight operations, with DP World partnering with Einride to electrify inter-terminal flows, further emphasizes the modern logistics ecosystem where every component—including pallets—must meet higher operational standards.

Smart pallet technology is turning these simple platforms into active data nodes that enhance supply chain intelligence. RFID tags, QR codes, and IoT sensors embedded in pallets enable real-time tracking throughout distribution networks, providing precise data on location, condition monitoring (temperature, shock, tilt), and inventory levels. This technology improves inventory accuracy, reduces asset loss, enables predictive maintenance, and optimizes pallet utilization across the supply chain. With e-commerce volumes surging and warehouses rapidly automating to handle increased throughput, the demand for sensor-equipped smart pallets is accelerating. These intelligent pallets give logistics managers instant visibility over their entire operations, facilitating rapid decision-making during disruptions or demand spikes. The ability to track assets automatically without manual scanning saves time and labor while providing data analytics that help optimize routing, reduce idle times, and improve overall operational efficiency across UAE's sophisticated logistics infrastructure.

UAE Pallet Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Wood

- Plastic

- Metal

- Corrugated Paper

Application Insights:

- Food and Beverages

- Chemicals and Pharmaceuticals

- Machinery and Metal

- Construction

- Others

Structural Design Insights:

- Block

- Stringer

- Others

Breakup by Region:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in UAE Pallet Market

- March 2025: DP World expanded electric freight operations at Jebel Ali Port through its partnership with Einride, advancing sustainable inter-terminal container flows and setting new standards for green logistics infrastructure that require compatible pallet systems.

- August 2025: DP World launched a major automotive logistics expansion at Jebel Ali Port's Terminal 4, adding 2.6 million square feet and increasing storage capacity to 75,000 car equivalent units, driving demand for specialized pallets in automotive supply chains.

- September 2025: Americold opened its flagship import-export hub at Jebel Ali Free Zone with 40,000 pallet positions and multi-temperature capabilities, connecting global food producers to GCC markets and boosting demand for food-grade, temperature-resistant pallet solutions.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302