Form 6765 instructions help businesses claim the R&D tax credit, figure qualified research expenses (QREs), elect the payroll credit, and maximize tax benefits using accurate IRS guidance.

Table of Contents

- What Is Form 6765 and Who Uses It?

- What Is Form 6765 Used For?

- Key Terms You Should Know

- Qualified Research Expenses (QREs)

- Alternative Simplified Credit (ASC)

- Step‑by‑Step IRS Form 6765 Instructions

- Sections A through D

- 2025 Changes and What’s New

- Who Qualifies for R&D Tax Credit?

- How to Calculate ASC vs Regular Method

- Documents You Need

- Can Startups Use Payroll Offset?

- Common Mistakes to Avoid

- Filing Tips and Contact

- Conclusion

- FAQ

1. What Is Form 6765 and Who Uses It?

Form 6765, Credit for Increasing Research Activities, lets businesses claim a federal tax credit for qualified research. It also includes elections like reduced credit under section 280C and payroll tax credits. Partnerships and S corporations file it directly, while other business entities report the credit on Form 3800 if not filing Form 6765. For detailed guidance on completing the form accurately, refer to our comprehensive Form 6765 Instructions to ensure every section is filled correctly and maximize your R&D tax benefits.

If you conduct research or development that advances products, processes, software, or technology, this form matters.

2. What Is Form 6765 Used For?

Form 6765 is used to:

- Figure and claim the R&D tax credit for increasing research activities

- Elect the reduced credit under IRS section 280C

- Elect the payroll tax credit instead of a business tax credit

This credit can reduce income tax liability or, for early‑stage businesses, some payroll tax. That’s a real financial win, especially for innovation‑driven companies.

3. Key Terms You Should Know

Qualified Research Expenses (QREs)

QREs are costs tied directly to research that meets IRS tests, including wages, supplies, and contract research. These form the base for credit calculation.

Alternative Simplified Credit (ASC)

The ASC method streamlines the credit calculation and often simplifies recordkeeping. Many companies use it to navigate complex calculations while maximizing credit value.

4. Step‑by‑Step IRS Form 6765 Instructions

The official IRS instructions break the form into logical sections. Here’s how it flows:

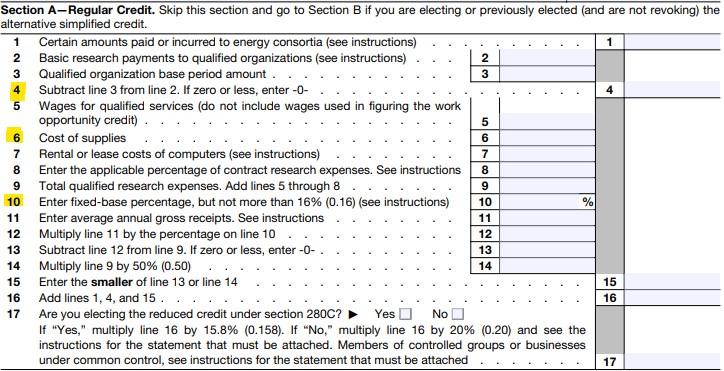

Section A: Regular Credit and Section 280C Election

You report basic qualified research costs and decide if you take the reduced credit under section 280C. If you check yes, your credit amount decreases slightly but simplifies tax treatment.

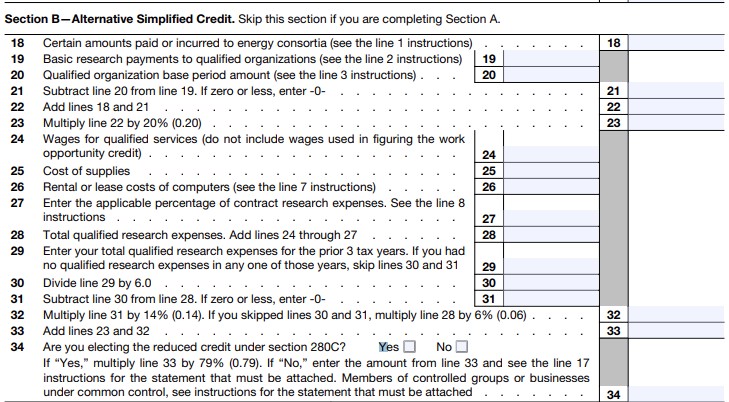

Section B: Alternative Simplified Credit (ASC)

Choose this if you want a more straightforward way to figure your research credit using past expenses. This can reduce your documentation burden while keeping accuracy.

Section F: Qualified Research Expenses Summary

List all QREs and totals. This feeds the core values used in credit calculation.

Section D: Payroll Tax Credit Election

If your business qualifies, you can elect part of your credit against employer payroll tax instead of income tax. This option attracts many startups with little or no income tax liability.

5. 2025 Changes and What’s New

The IRS updated the 2025 Form 6765 instructions with new sections and clarified reporting requirements. It now includes Section E (Other Information), Section F (QRE Summary), and Section G (Business Component Info). For the 2025 tax year, Section G is optional, but it becomes required for most filers in future tax years.

This change gives businesses time to adjust while gathering detailed reporting components.

Quick Tip: Learn how to fill out a 1040 form step by step to report income, claim deductions, and ensure accurate tax filing with IRS-compliant guidance.

6. Who Qualifies for R&D Tax Credit?

Businesses of all sizes may qualify if they:

- Conduct experimentation or research activities

- Aim to improve products, processes, software, or technology

- Can support expenses with valid documentation

Startups and small companies often qualify for payroll tax credits if they don’t owe income tax. The IRS caps the payroll offset at $500,000 per year.

7. How to Calculate ASC vs Regular Method

The regular method uses a formula based on your historical research expenses. The ASC uses a simpler percentage over recent years’ QREs. While the regular method may yield a larger credit in some cases, ASC often reduces complexity. Your accountant or tax advisor can help determine which version benefits you more.

8. Documents You Need

Before you file, gather:

- Payroll records showing QRE wages

- Supply cost documentation

- Contracts for external R&D services

- Accounting reports showing expense allocations

Better documentation means stronger audit protection and faster processing.

For broader business insights and financial patterns, see our study on Financial Literacy Statistics.

9. Can Startups Use Payroll Offset?

Yes. If you’re a qualified small business, you may elect to use your credit against payroll taxes instead of income tax. This benefit often appeals to startups with little or no income tax liability. The IRS limits the offset to $500,000 per year.

This election must be made on your timely filed return.

10. Common Mistakes to Avoid

Filing Form 6765 isn’t trivial. Avoid these:

- Skipping QRE documentation

- Picking the wrong credit calculation method

- Forgetting to attach forms like Form 8974 when claiming payroll credits

A small error can delay processing or reduce your credit.

11. Filing Tips and Contact

Filing Form 6765 takes care and precision. If your situation feels complex, BooksMerge can help you navigate every step with confidence. We ensure credits are calculated correctly and maximize your tax advantage. Call +1-866-513-4656 to get expert guidance and personalized support.

Conclusion

Understanding the IRS Form 6765 instructions helps your business claim valuable research tax credits. Whether you use the regular method, the ASC, or elect payroll tax credits, accurate documentation and clear steps are key. For personalized help, BooksMerge stands ready to support your tax needs every step of the way.

FAQ

What is Form 6765 used for?

Form 6765 is used to figure and claim the federal research tax credit and elect payroll or reduced credits.

Who qualifies for R&D tax credit?

Businesses that conduct qualified research activities aimed at technological or process improvements may qualify.

What are QREs?

Qualified Research Expenses are costs directly tied to qualified research, such as wages and supplies.

How to calculate ASC vs regular method?

ASC uses recent years’ research costs for a simpler formula, while the regular method uses a broader historical base. A professional can advise what’s best.

What documents are required?

Payroll records, expense receipts, contracts, and documentation supporting QREs are essential for a valid claim.

Can startups use payroll offset?

Yes. Qualified small businesses can elect to apply the credit against payroll tax up to $500,000.

What changed in 2025?

New sections in the instructions and optional early reporting requirements give taxpayers flexibility for the 2025 filing year.

Read Also: Form 6765 Instructions