Market Overview:

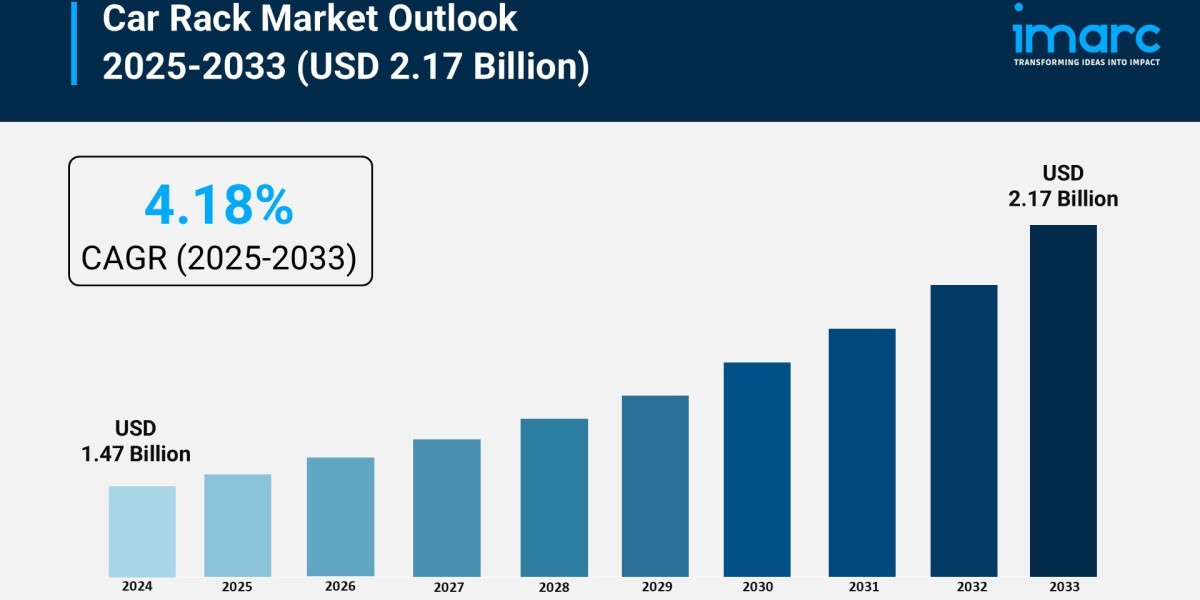

The car rack market is experiencing rapid growth, driven by surge in outdoor recreational participation, rising dominance of suvs and crossovers, and technological advancements in materials and design. According to IMARC Group's latest research publication, "Car Rack Market Size, Share, Trends and Forecast by Type, Material, End Use, and Region, 2025-2033, The global car rack market size was valued at USD 1.47 Billion in 2024. The market is projected to reach USD 2.17 Billion by 2033, exhibiting a CAGR of 4.18% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/car-rack-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Car Rack Market

- Surge in Outdoor Recreational Participation

The primary driver for the car rack market is the global explosion in outdoor recreational activities, with nearly 43% of consumers worldwide reporting increased engagement in biking, kayaking, and camping. This behavioral shift has created a direct necessity for reliable equipment transport solutions that extend beyond a vehicle's standard interior capacity. In North America alone, over 190 million people are estimated to be active participants in outdoor recreation, fueling high demand for specialized bike racks and watersport carriers. To capitalize on this interest, companies like Thule and Yakima are expanding their portfolios with heavy-duty hitch racks and rooftop tents designed for extended off-road use. This growth is further supported by the rise in "work-from-anywhere" trends, where individuals invest in premium rack systems to facilitate frequent weekend escapes, effectively turning their daily commuters into capable adventure vehicles for diverse terrains.

- Rising Dominance of SUVs and Crossovers

The structural shift in the automotive market toward Sports Utility Vehicles (SUVs) and crossovers provides a robust foundation for car rack adoption, as these vehicles currently account for roughly 55% of global car sales. SUVs are inherently designed with utility in mind, frequently featuring factory-installed roof rails that simplify the mounting of aftermarket rack systems. In the United States, where SUVs represent over half of total vehicle sales, consumers are increasingly viewing car racks as essential lifestyle accessories rather than optional add-ons. Manufacturers are responding by engineering vehicle-specific custom-fit solutions that ensure maximum stability and ease of installation for these larger frames. Additionally, the growing popularity of converting camper vans and light trucks into mobile homes has intensified the need for high-capacity roof boxes and modular cargo systems, as travelers seek to maximize storage for long-distance journeys.

- Technological Advancements in Materials and Design

Continuous innovation in material science is significantly lowering the barriers to car rack adoption by addressing historical concerns regarding weight and fuel efficiency. Modern racks are increasingly manufactured using high-strength aluminum alloys and composite plastics, with aluminum segments currently holding a 53% market share due to their superior strength-to-weight ratio and corrosion resistance. These lightweight materials are critical for maintaining vehicle performance and minimizing the impact on fuel consumption or electric vehicle (EV) battery range. Companies are investing heavily in aerodynamic profiling, with advanced models now featuring integrated wind deflectors and noise-reducing shapes to improve air-flow efficiency by up to 48%. Furthermore, the integration of smart features, such as app-based load monitoring sensors and anti-theft locking mechanisms, has enhanced consumer trust, making high-end rack systems a more attractive investment for security-conscious owners of expensive sporting equipment.

Key Trends in the Car Rack Market

- Adaptation for Electric Vehicle Compatibility

As the automotive world pivots toward electrification, car rack manufacturers are prioritizing designs that minimize "range anxiety" caused by aerodynamic drag. Currently, about 37% of buyers specifically seek lightweight, EV-compatible racks that do not drastically reduce the distance per charge. This trend is leading to the development of ultra-low-profile roof boxes and rear-mounted hitch racks, which are positioned to sit in the vehicle's aerodynamic wake to reduce resistance. For example, some brands are now testing "active aero" components that adjust the rack's profile based on speed. With roughly 40% of new EVs expected to be equipped with roof rail provisions, the industry is shifting away from heavy, bulky steel frames toward streamlined, energy-efficient attachments that complement the quiet and efficient nature of electric drivetrains.

- Shift Toward Modular and Multi-Purpose Systems

Modern consumers are increasingly moving away from single-use accessories in favor of modular rack systems that can be reconfigured for different seasons and sports. Approximately 45% of car owners now prefer racks that support multiple attachments, such as a base bar system that can swap a bike carrier for a ski rack or a cargo basket in minutes. This "platform approach" allows users to invest in one high-quality foundation and customize it based on their immediate needs. Real-world applications include integrated T-track systems and quick-release mounting hardware that require no specialized tools for assembly. This trend is particularly popular among urban dwellers with limited storage space, as modular components are often designed to be foldable or easily detachable, allowing the vehicle to return to its sleek, rack-free profile when the adventure ends.

- Digital Customization and E-Commerce Integration

The way consumers discover and purchase car racks is being revolutionized by digital tools and direct-to-consumer (DTC) channels, which now account for 58% of total global sales. Online retailers and manufacturers are deploying advanced digital configurators that allow users to input their specific vehicle make, model, and year to see a virtual 3D rendering of how a rack will fit and look. This has significantly reduced the risk of purchasing incompatible parts, a major pain point in the past. Furthermore, social media influence now impacts approximately 32% of car rack purchases, as "overlanding" influencers showcase their gear setups to highly engaged audiences. This digital shift is pushing brands to enhance their online presence with detailed installation videos and augmented reality (AR) features, enabling a seamless shopping experience from mobile devices to the driveway.

Leading Companies Operating in the Global Car Rack Industry:

- ACPS Automotive GmbH

- Atera GmbH

- Bosal Nederland B.V.

- Cruzber SA

- KAMEI GmbH & Co. KG

- Magna International Inc.

- Mont Blanc Group AB (Brenderup Group AB)

- Thule Group AB

- VDL Hapro B.V.

- Yakima Products Inc. (Kemflo International Co. Ltd.)

Car Rack Market Report Segmentation:

By Type:

- Roof Rack

- Roof Box

- Bike Car Rack

- Ski Rack

- Watersport Carrier

- Others

Roof racks represent the largest market share in 2024, favored for their practicality in transporting various outdoor items without occupying interior space and their compatibility with SUVs and crossovers.

By Material:

- Aluminum Alloy

- Composite Plastic

- Stainless Steel

- Others

Aluminum alloy accounts for 42.1% of the market share, combining strength, durability, and lightweight properties, making it ideal for vehicle accessories while minimizing rust and enhancing fuel efficiency.

By End Use:

- OEM

- Aftermarket

The aftermarket segment holds the largest market share, offering a wide range of customizable products that cater to diverse user needs for activities like biking and skiing, with easy installation appealing to DIY users.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America leads the market with a 37.8% share, driven by a strong outdoor culture, high car ownership, and the popularity of SUVs and pickup trucks, supported by extensive retail networks and user awareness.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302