Form 6765 Instructions explain how businesses claim the IRS R&D tax credit, calculate qualified research expenses, choose the right credit method, and apply payroll tax offsets correctly.

Table of Contents

- Introduction

- What is Form 6765 used for?

- Who qualifies for R&D tax credit?

- What are QREs?

- How to calculate ASC vs regular method?

- Instructions for Form 6765 step by step

- What documents are required?

- Can startups use payroll offset?

- What changed in 2025?

- Smart recordkeeping and compliance tips

- Conclusion

- FAQs

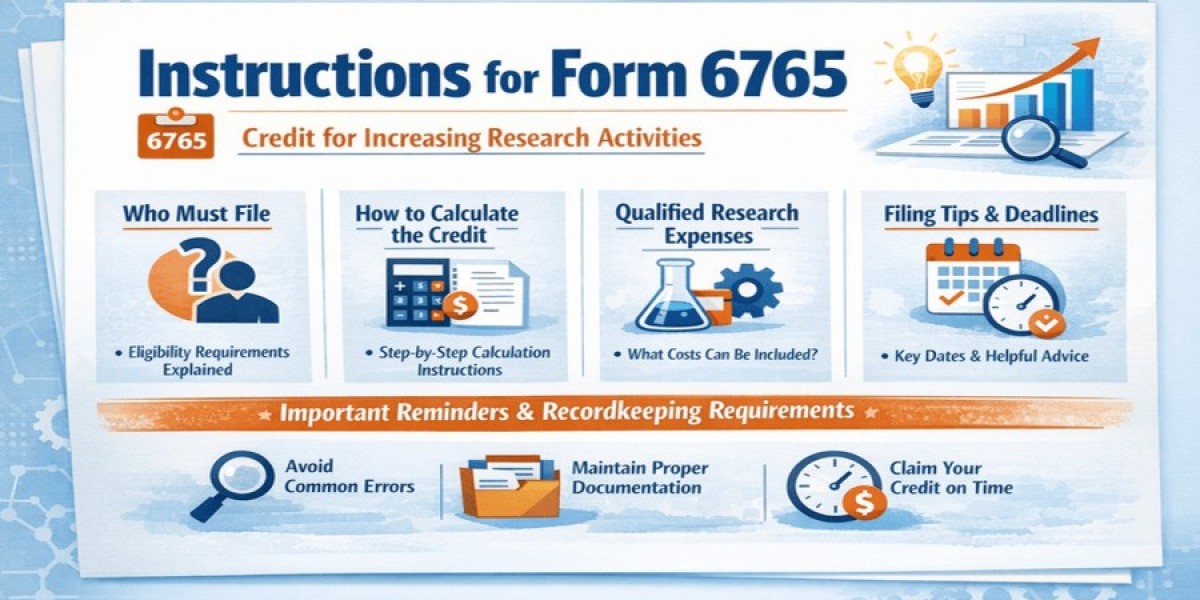

Introduction

Form 6765 Instructions serve as the official IRS guide for claiming the federal Credit for Increasing Research Activities, commonly known as the R&D tax credit. These instructions help businesses understand how to calculate qualified research expenses, select the correct credit method, and make important elections such as the reduced credit under Section 280C or payroll tax offset. Following IRS Form 6765 Instructions carefully helps reduce filing errors and strengthens audit readiness. At BooksMerge, we support businesses with accurate R&D credit filing backed by strong documentation. For professional guidance, call +1-866-513-4656.

What is Form 6765 used for?

Form 6765 is used to calculate and claim the federal R&D tax credit allowed under Internal Revenue Code Section 41. Businesses use this form to:

- Claim the research credit for current tax year

- Choose between the regular method or Alternative Simplified Credit

- Elect the reduced credit under Section 280C

- Apply a portion of the credit against payroll taxes if eligible

Simply put, Form 6765 turns innovation costs into tax savings when completed correctly.

Who qualifies for R&D tax credit?

Many businesses qualify without realizing it. You do not need a lab coat or patent pending sign.

A business qualifies for the R&D tax credit if its activities meet the IRS four-part test:

- The activity aims to create or improve a product, process, software, or formula

- The work involves technical uncertainty

- The research relies on principles of engineering, science, or computer science

- The activity includes a process of experimentation

Manufacturers, software developers, engineers, architects, and startups often qualify. Even failed projects can count if they involved experimentation.

What are QREs?

QREs stand for Qualified Research Expenses, and they form the backbone of Form 6765 calculations.

QREs generally include:

- Employee wages for staff performing, supervising, or supporting R&D

- Supplies used during research activities

- Contract research costs paid to third parties, subject to IRS limits

General overhead, marketing costs, and administrative expenses do not qualify. Clear tracking of research costs helps ensure compliance and maximizes credits.

How to calculate ASC vs regular method?

The IRS allows two methods for calculating the R&D credit. Choosing the right one matters.

Regular Credit Method

This method compares current year QREs to a base amount derived from historical data and gross receipts. It often produces higher credits for businesses with long research histories but requires more documentation.

Alternative Simplified Credit (ASC)

ASC uses a simpler formula based on the average QREs from the prior three years. Many small and mid-sized businesses prefer ASC due to lower complexity and reduced recordkeeping burden.

Once elected, ASC generally applies going forward unless revoked. Modeling both methods helps determine which provides the best result.

Quick Tip: Complete and updated IRS form list covering all essential tax forms, instructions, and filing resources for individuals, startups, and businesses in one place.

Instructions for Form 6765 step by step

Understanding Instructions for Form 6765 becomes easier when you break the form into sections.

Section A: Regular Credit

Enter QREs, base amounts, and credit calculations using the regular method.

Section B: Alternative Simplified Credit

Elect ASC here and compute the credit using simplified averages.

Section C: Additional Forms

Credits from partnerships or S corporations flow through Form 3800.

Section D: Payroll Tax Election

Eligible small businesses may elect to offset payroll taxes using part of the credit.

Sections E, F, and G

These sections summarize QREs and business components. Section G reporting expands starting in later tax years, so preparation matters.

Following Instructions Form 6765 line by line reduces delays and IRS follow-up requests.

What documents are required?

The IRS expects businesses to maintain supporting documentation even though it is not submitted with the return.

Required records include:

- Payroll reports tied to research employees

- Time tracking or project allocation records

- Invoices for supplies used in research

- Contracts and payment records for third-party research

- Technical documentation showing experimentation

Good documentation does more than protect credits. It also improves financial discipline. For insight into how strong financial practices impact small businesses, read this resource:

financial literacy statistics

Can startups use payroll offset?

Yes. Qualified small businesses can apply up to a set limit of the R&D credit against employer payroll taxes.

This option helps startups with limited income tax liability benefit from the credit sooner. Eligibility depends on gross receipts thresholds and operational history.

The payroll offset election must be made on Form 6765 and coordinated with payroll filings. Proper timing and planning are essential.

What changed in 2025?

The form 6765 instructions 2025 updates focused on increased transparency and reporting clarity.

Key changes include:

- Expanded business component reporting requirements

- Section G reporting delayed for some taxpayers in 2025

- Additional guidance on refund claims and amended filings

- IRS request for feedback on reporting burden and clarity

These changes signal a stronger focus on documentation quality rather than credit elimination. Preparing now helps future filings run smoother.

Smart recordkeeping and compliance tips

Good habits save time and money.

- Assign project codes to research activities

- Track time weekly instead of retroactively

- Keep digital copies of invoices and contracts

- Review credit calculations annually

Strong records support R&D credits and improve overall accounting accuracy. BooksMerge integrates tax compliance with bookkeeping and payroll support so your data stays connected and reliable.

Conclusion

Following Form 6765 Instructions correctly helps businesses convert innovation into measurable tax savings. From understanding QREs to selecting the right credit method and preparing for post-2025 reporting changes, accuracy matters at every step. Businesses that document well and plan early reduce risk and increase returns. If you want expert guidance backed by experience and clarity, BooksMerge is here to help. Call +1-866-513-4656 today.

FAQs

What is Form 6765 used for?

Form 6765 calculates and claims the federal R&D tax credit and allows elections for reduced credit or payroll tax offset.

Who qualifies for R&D tax credit?

Businesses performing qualified research involving experimentation and technical uncertainty may qualify across many industries.

What are QREs?

QREs include wages, supplies, and limited contract research costs directly tied to qualified research activities.

How to calculate ASC vs regular method?

ASC uses a simplified average of prior QREs, while the regular method relies on historical base calculations.

What documents are required?

Payroll records, invoices, project logs, contracts, and technical documentation support Form 6765 claims.

Can startups use payroll offset?

Yes, qualifying startups can apply part of the credit against payroll taxes instead of income tax.

What changed in 2025?

The IRS expanded reporting guidance and delayed certain requirements while gathering taxpayer feedback.

Read Also: Form 6765 Instructions