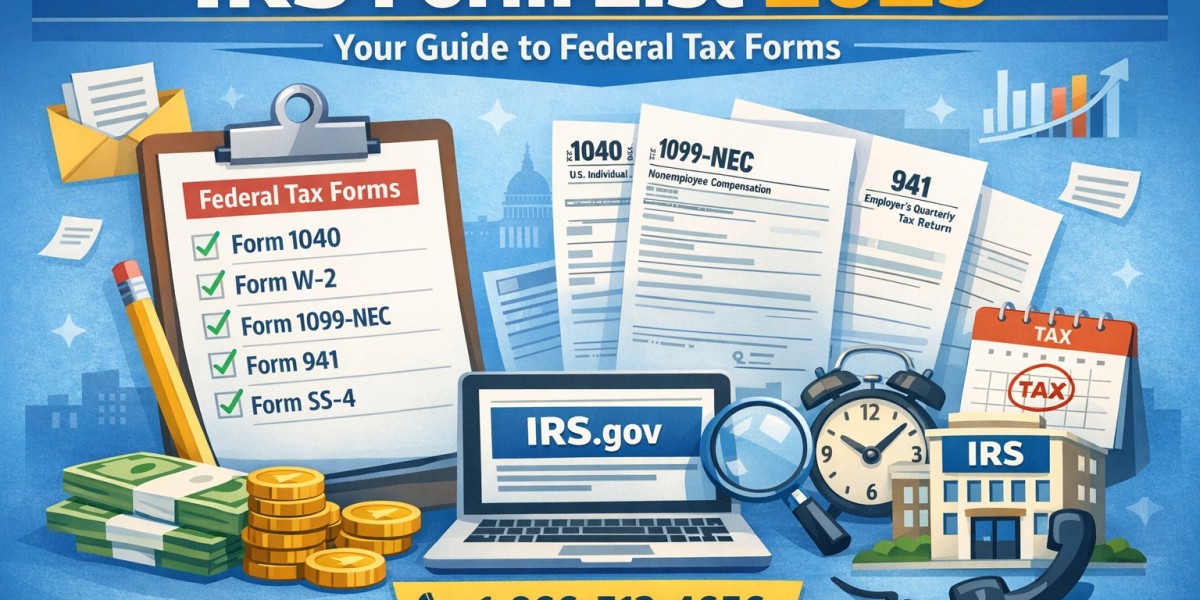

An IRS form list organizes all federal tax forms you may need, from Form 1040 for individuals to payroll and business returns, helping you file accurately and confidently.

Welcome to BooksMerge’s complete guide to the IRS form list. If tax season makes your head spin, you are not alone. Millions of taxpayers struggle each year to find the correct tax forms, understand how they fit into the filing process, and use them properly.

A missing or incorrect form can delay refunds, trigger audits, or even cost you money. This guide spells everything out clearly, with facts you can trust, real examples, and step‑by‑step help. Whether you are an individual filer, a small business owner, or a payroll manager, you will find what you need here.

Let’s get started with an easy‑to‑follow roadmap of this comprehensive guide.

Table of Contents

- Why an IRS Form List Matters

- How the IRS Organizes Federal Tax Forms

- How to Access IRS Forms and Instructions

- 5 Key Tax Forms Every Filer Should Know

- Full Directory of IRS Forms for Individuals

- IRS Forms for Business Filers

- Payroll, Withholding, and Employer Tax Forms

- Specialized IRS Forms and Credits

- IRS Forms for Estates, Trusts, and Gifts

- International Tax Forms

- New IRS Forms and Updates for 2025 Tax Filing

- How to Use an IRS Form List Efficiently

- Tips for Accurate Filing Using the IRS Form List

- Common Tax Form Mistakes and How to Avoid Them

- Tools and Resources for Managing IRS Forms

- The Role of Professional Help — When You Need It

- Summing Up

- Frequently Asked Questions (FAQs)

1. Why an IRS Form List Matters

When you think of taxes, you might picture complex instructions and endless paperwork. The reality is that the IRS maintains an organized IRS form list that catalogs every official federal tax form.

and its instructions.

and its instructions.

This list is essential because:

- It helps taxpayers know what they need to file

- It reduces mistakes and late submissions

- It ensures you attach the right schedules and statements

- It helps you find forms related to credits, deductions, and special tax situations

Without a clear form list, you could miss out on important tax credits or file incorrect returns that trigger audits or fines.

2. How the IRS Organizes Federal Tax Forms

The IRS sorts forms by type, taxpayer category, and purpose. While there are thousands of forms and schedules in the full directory, most taxpayers only need a handful.

Key categories include:

- Individual Tax Forms — for personal income filing

- Business Tax Forms — for corporations, partnerships, LLCs, and sole proprietors

- Payroll and Withholding Forms — used by employers

- Credits and Deductions Forms — for claiming specific tax benefits

- Estate, Gift, and Trust Forms — for non‑individual tax situations

- International Forms — for foreign income, expatriate, or multinational reporting

Most IRS forms list can be found on the official IRS forms and instructions page at IRS.gov/forms‑instructions, where each form links directly to downloadable PDFs and official guidance.

3. How to Access IRS Forms and Instructions

The IRS provides all tax forms and publications online for free. You can access them by:

- Visiting the IRS forms and instructions page

- Searching by form number (such as Form 1040)

- Searching by keyword (such as “business return,” “payroll,” or “credit”)

Each IRS form page typically includes:

- The form itself

- A full instruction document

- Details on who must file it

- Filing deadlines and rules

Using the official IRS form list ensures you always rely on the most recent tax year versions.

(Source: IRS.gov/forms‑instructions)

4. 5 Key Tax Forms Every Filer Should Know

While the IRS form list is extensive, most taxpayers will work with a core set of forms. Knowing these is half the battle.

Top 5 Essential Tax Forms

- Form 1040 — Individual Income Tax Return

Every individual taxpayer uses this form or its variants. - Form W‑2 — Wage and Tax Statement

Employers provide this to employees, reporting wages and tax withholding. - Form 1099 Series — Miscellaneous Income Reporting

Freelancers, contractors, and investors may receive various 1099s. - Schedule C — Profit or Loss from Business

Sole proprietors and self‑employed individuals use this to report business income. - Form 941 — Employer’s Quarterly Tax Return

Businesses use this to report payroll tax liabilities quarterly.

These are foundational forms you will see again and again when navigating the IRS form list.

5. Full Directory of IRS Forms for Individuals

Individuals may need several forms depending on their situation. Here’s a detailed look at the most commonly used:

Income Reporting

- Form 1040

The main individual tax return form. - Schedule 1

Reports additional income and adjustments. - Schedule 2

Captures additional taxes owed. - Schedule 3

For non‑refundable credits.

Estimated Payments and Extensions

- Form 1040‑ES

Required for taxpayers making estimated quarterly tax payments. - Form 4868

Filed to request a six‑month filing extension.

Itemizing and Credits

- Schedule A

Itemized deductions (medical, mortgage interest, etc.) - Schedule B

Interest and dividend income

Individuals with investments, rental income, or special tax situations may use additional forms.

6. IRS Forms for Business Filers

Businesses have a broader set of forms based on their structure:

Business Return Forms

- Form 1120 — Corporate Tax Return

For C corporations. - Form 1120‑S — S Corporation Return

- Form 1065 — Partnership Return

- Schedule C — Sole Proprietorship Income

Employment and Payroll Taxes

- Form 940 — Annual Federal Unemployment Tax

- Form 941 — Quarterly Federal Tax Return

- Form 944 — Employer’s Annual Federal Tax Return

Business Credits and Deductions

- Form 4562 — Depreciation and Amortization

- Form 8829 — Business Use of Home

This section of the IRS form list is crucial for any business owner. Choosing the wrong form can lead to penalties.

7. Payroll, Withholding, and Employer Tax Forms

Whether you employ one person or one hundred, the IRS form list includes essential payroll reporting forms:

Employee Documents

- Form W‑4 — Employee Withholding Certificate

Helps employers calculate withholding. - Form W‑2 — Wage and Tax Statement

- Form W‑3 — Transmittal of Wage and Tax Statements

Contractor Reporting

- Form 1099‑NEC — Non‑Employee Compensation

These forms ensure taxes are correctly withheld and reported for wages and contractor payments.

8. Specialized IRS Forms and Credits

Beyond basic filing, many taxpayers use IRS forms for specific tax credits and situations. Examples include:

- Form 8862 — Information to Claim Certain Credits

- Form 8962 — Premium Tax Credit

- Form 8995 — Qualified Business Income Deduction

One important specialized form often referenced is Form 6765 — Instructions for R&D Tax Credit, which helps businesses claim the credit for eligible research expenses.

Quick Tip: Form 6765 instructions guide businesses on claiming the R&D tax credit, detailing eligible expenses, calculation methods, and proper IRS filing steps.

9. IRS Forms for Estates, Trusts, and Gifts

Taxpayers dealing with estates or gifts may see unique forms:

- Form 706 — United States Estate (and Generation‑Skipping Transfer) Tax Return

- Form 709 — United States Gift (and Generation‑Skipping Transfer) Tax Return

- Form 1041 — U.S. Income Tax Return for Estates and Trusts

These appear less frequently but are critical for compliance in estate planning and legacy matters.

10. International Tax Forms

For U.S. taxpayers with foreign income, investments, or residency matters:

- Form 2555 — Foreign Earned Income Exclusion

- Form 1116 — Foreign Tax Credit

- Form 5471 — Information Return of U.S. Persons With Respect to Certain Foreign Corporations

Understanding which international forms apply is vital for accurate reporting.

11. New IRS Forms and Updates for 2025 Tax Filing

The IRS updates forms annually. For tax year 2025 filings, many forms now include:

- Enhanced fillable PDFs

- Updated software filing compatibility

- New schedules for credits and deductions

Always rely on the latest IRS form list at the official site to ensure you are using the correct tax year forms. Using outdated versions can result in rejection or processing delays.

12. How to Use an IRS Form List Efficiently

Here’s a simple method to navigate the IRS form list like a pro:

- Identify Your Filing Category: Individual, business, payroll, or investment

- Search by Form Number or Keyword: The IRS form list is searchable online

- Download Forms and Instructions: Follow official line‑by‑line guidance

- Prepare Supporting Documents: Match forms with receipts, wages, and records

- Use Electronic Filing: IRS e‑file and tax software reduce errors

Approach the IRS form list methodically to reduce stress and improve accuracy.

13. Tips for Accurate Filing Using the IRS Form List

Accuracy is vital. These practical tips help:

- Double‑check form titles and numbers before filing

- Attach all required schedules with your return

- File electronically to catch simple errors

- Keep copies of everything for IRS audits or future reference

Professional payroll and tax services can assist if you feel unsure.

14. Common Tax Form Mistakes and How to Avoid Them

Even experienced filers make mistakes:

- Filing the wrong tax year form

- Missing signatures or dates

- Incorrect Social Security or EIN numbers

- Misclassifying income or expenses

Using the IRS form list and official instructions minimizes these risks.

15. Tools and Resources for Managing IRS Forms

Some useful tools:

- IRS official forms and instructions page

- Tax preparation software with guided form selection

- BooksMerge services at +1‑866‑513‑4656 for expert help

- IRS Interactive Tax Assistant tools online

These tools help you determine which forms are right for your situation.

16. The Role of Professional Help — When You Need It

Tax rules change. Situations grow complicated. When you face:

- Multiple income streams

- Business filing requirements

- Credits and deductions

- Payroll or employment tax questions

Professional help, like BooksMerge, ensures you choose the correct forms and avoid costly errors.

17. Summing Up

The IRS form list is a powerful resource. It helps you find and file exactly what you need, whether you are:

- Filing a simple individual return

- Running payroll for a small business

- Claiming credits and deductions

- Managing complex trust or estate taxes

With the right forms and accurate preparation, taxes become manageable — and even understandable.

Need hassle‑free guidance? Call +1‑866‑513‑4656 to speak with a BooksMerge expert who simplifies tax filing with confidence.

18. Frequently Asked Questions (FAQs)

What is the IRS form list?

The IRS form list catalogs all official federal tax forms and their instructions, helping taxpayers find exactly what they need.

Where can I access IRS tax forms for 2025?

Visit the official IRS forms and instructions page on IRS.gov and search by form number or keyword.

Which forms do individuals commonly use?

Common individual forms include Form 1040, Schedules A‑3, and support forms like 1040‑ES.

What are essential business forms?

Businesses often use Form 1120, Form 1065, Schedule C, and payroll forms like Form 941.

Do IRS forms change every year?

Yes. The IRS updates forms and instructions annually, so always check the official IRS form list.

How do I find a form by number?

On the IRS forms page, use the search function to locate forms by number or title.

Read Also:Form 6765 Instructions