Global EPA and DHA Market is experiencing robust expansion as consumer focus on preventive healthcare, cardiovascular wellness, cognitive development, and prenatal nutrition intensifies globally. EPA (eicosapentaenoic acid) and DHA (docosahexaenoic acid) — two principal long-chain omega-3 fatty acids — are increasingly incorporated across dietary supplements, functional foods, infant formulas, and pharmaceutical formulations, driven by growing clinical evidence, rising health awareness, and expanding product formulation technologies that enhance purity and bioavailability.

This comprehensive analysis examines market drivers, segmentation, regional dynamics, competitive trends, regulatory considerations, and future outlook for the EPA and DHA Market, offering actionable insights for manufacturers, ingredient suppliers, and channel partners.

Market Overview

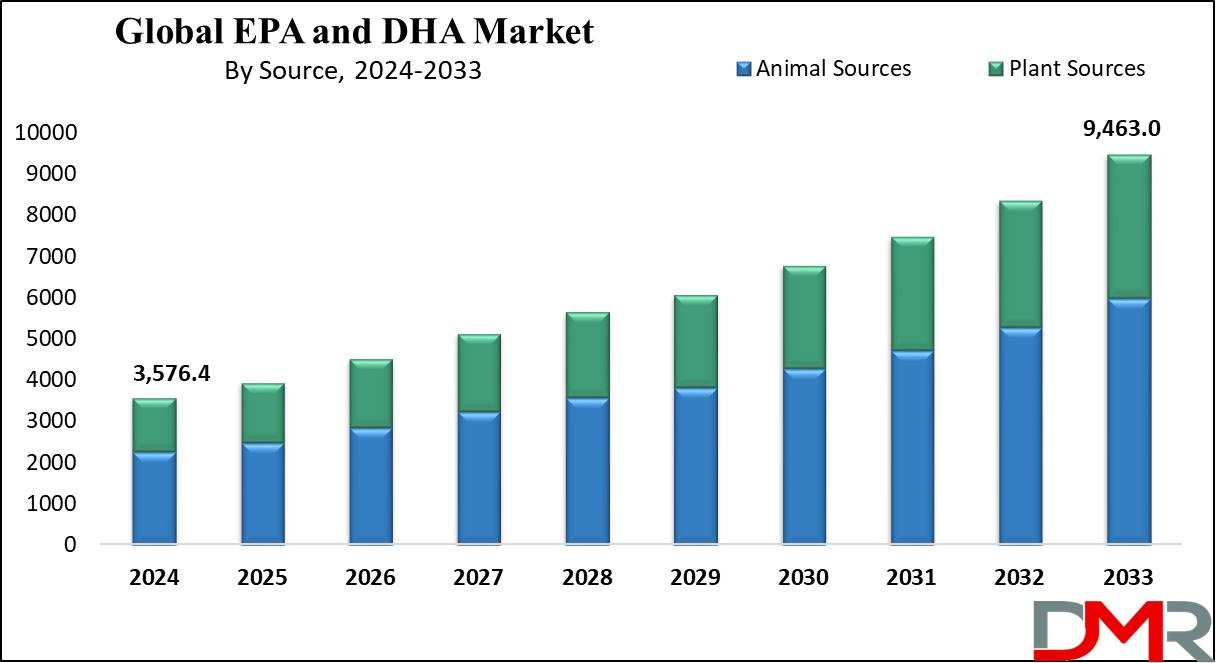

The Global EPA and DHA Market size is expected to reach USD 3,576.4 Million in 2024 and is further projected to attain USD 9,463.0 Million by 2033 at a compound annual growth rate (CAGR) of 11.4%. Growth is underpinned by multiple converging factors: rising prevalence of lifestyle-related disorders that benefit from omega-3 support, increasing demand for prenatal and pediatric nutrition with DHA enrichment, growing adoption of supplements among aging populations for cognitive and cardiovascular health, and the expansion of fortified functional foods and beverages.

Technological advances in extraction, purification, microencapsulation, and emulsification have improved sensory profiles and stability, enabling wider application across formats such as softgels, gummies, emulsions, powders, and fortified foods. E-commerce channel growth and direct-to-consumer marketing have accelerated reach to younger demographics, while clinical endorsements and physician recommendations continue to drive trust among older consumers and caregivers.

Market Dynamics

Primary drivers include the demonstrable health benefits of EPA and DHA for heart health, brain function, anti-inflammatory action, and maternal-child development. Consumer demand for preventive nutrition and natural health solutions remains strong, reinforced by broader wellness trends and increasing disposable incomes in emerging markets.

The rise of plant-based diets and sustainability concerns has catalyzed interest in algae-derived EPA and DHA, offering vegan-friendly, contaminant-free alternatives to traditional fish oil sources. Cost and supply concerns around marine-sourced ingredients, volatility in raw material prices, and environmental pressures on fisheries present challenges, but they also accelerate innovation toward cultivated, algal, and hybrid sourcing strategies. Regulatory acceptance for claims, along with clear labeling requirements and safety standards, continues to shape product positioning and market entry strategies.

Market Segmentation

By source, the market is primarily divided into fish oil, algae oil, krill oil, and other marine sources. Fish oil remains the most widely used due to established supply chains and cost-effectiveness, while algae oil is the fastest-growing source because it addresses sustainability, vegan preferences, and contamination concerns. Krill oil commands a premium position due to phospholipid-bound omega-3s that purportedly enhance absorption.

By form, softgels and capsules dominate owing to convenience and stability, but gummies and liquids are growing rapidly among younger consumers and pediatric applications. By application, dietary supplements capture the largest share, followed by functional foods and beverages, infant nutrition, pharmaceuticals, and animal nutrition. The infant nutrition segment is particularly important for DHA demand, as formula manufacturers continue to fortify products to support early neural and visual development. Functional food innovation—fortified dairy, bakery, beverages, and meal replacements—expands mainstream accessibility and creates incremental use cases beyond the traditional supplement aisle.

Regional Analysis

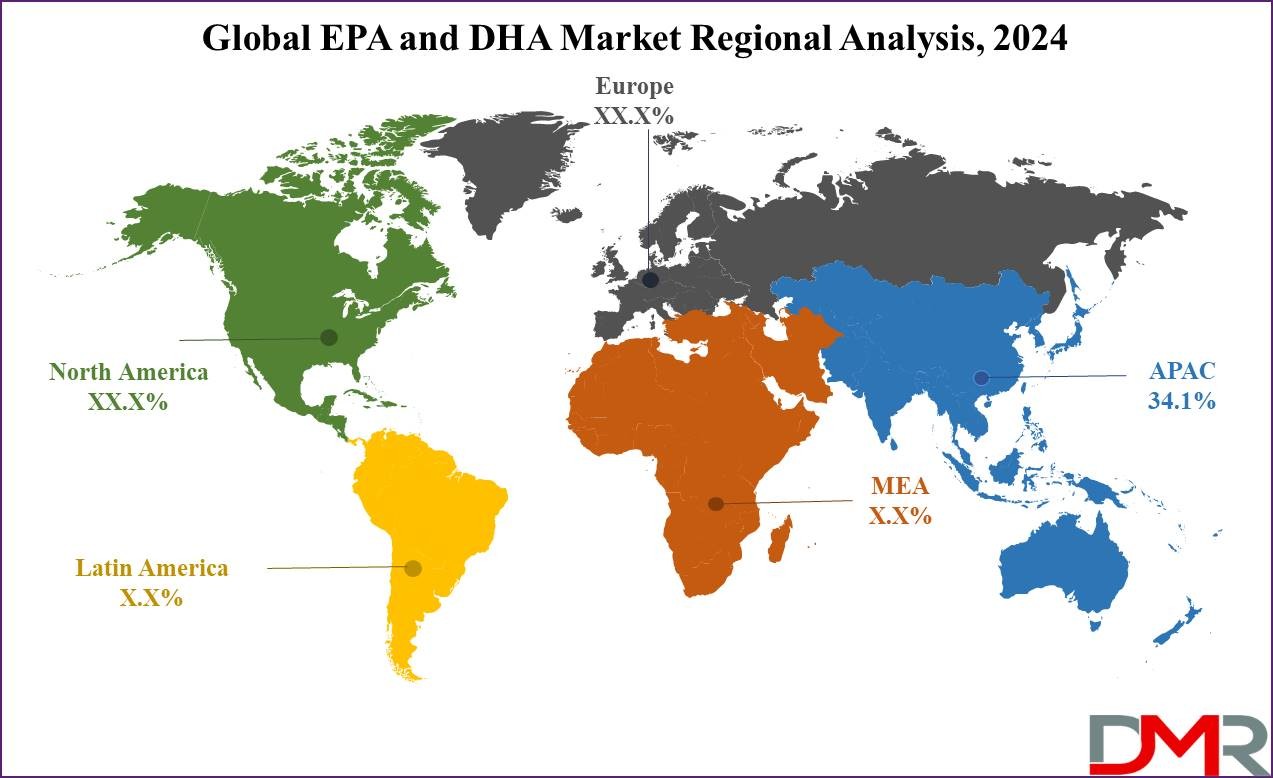

Asia Pacific is projected to be the largest and fastest-growing region in the Global EPA and DHA Market, holding 34.1% of the market share by the end of 2024. This dominance reflects the region’s expansive population base, rising disposable incomes, increasing urbanization, and growing health consciousness across China, India, Japan, and Southeast Asian markets. Rapid expansion of modern retail and e-commerce channels in Asia Pacific enables broad distribution of both premium and value-oriented omega-3 products.

North America remains a mature and significant market driven by high per-capita supplement consumption, strong clinical advocacy for omega-3s in cardiovascular and cognitive health, and a well-established specialty retail and direct-to-consumer ecosystem. Europe maintains steady growth with a premiumization trend focused on sustainability credentials, traceability, and clean-label formulations. Latin America, the Middle East, and Africa are emerging markets with increasing opportunities as public awareness and disposable incomes rise, and as infant nutrition and preventive healthcare investments expand.

Download a Complimentary PDF Sample Report : https://dimensionmarketresearch.com/report/epa-and-dha-market/request-sample/

Competitive Landscape

Competition in the EPA and DHA Market centers on raw material differentiation, process innovation, product formulation, and channel penetration. Key strategies employed by market players include vertical integration to secure raw material supply, investment in algae cultivation and fermentation technologies to reduce dependence on wild-caught fish, and development of proprietary concentration and purification processes that deliver higher EPA/DHA ratios with reduced oxidation and better organoleptic properties.

Brands increasingly emphasize clinical substantiation, third-party testing, sustainability certifications (e.g., MSC, Friend of the Sea), and transparent sourcing to build trust among discerning consumers. Partnerships with infant formula manufacturers, pharmaceutical firms, and major CPG companies for co-development and private-label opportunities are growing, while digital marketing and subscription models help firms lock in recurring revenue streams.

Technology and Product Innovation

Innovation is a critical differentiator. Microencapsulation and advanced emulsification techniques have enabled incorporation of EPA and DHA into water-based beverages and heat-processed foods without off-flavors. Encapsulation improves oxidative stability and controlled release, enhancing shelf life and bioavailability.

Algae fermentation, precision cultivation, and heterotrophic production methods are reducing costs and scaling plant-based EPA/DHA supply. Novel delivery formats—effervescent tablets, chewables, and high-concentration concentrates—address diverse consumer preferences. Clinical research on targeted formulations (e.g., high-EPA for cardiovascular support; balanced EPA/DHA ratios for mood and cognition) supports more granular product positioning and premium pricing.

Regulatory Environment and Quality Assurance

Regulations governing nutrient claims, ingredient approvals, contaminant limits, and health claims vary across jurisdictions, affecting labeling, marketing, and permissible claim language. Manufacturers must adhere to stringent quality controls for peroxide values, heavy metal content, and oxidative stability.

Third-party certifications and clinical trial evidence enhance market acceptance and mitigate regulatory risk. Companies investing in traceability systems and digital provenance (blockchain-enabled supply chain tracking) gain competitive advantage by meeting retailer and regulatory expectations for transparency.

Adoption Challenges and Risk Factors

Key adoption barriers include price sensitivity in emerging markets, sensory challenges associated with marine oils, supply chain disruptions, and regulatory hurdles related to new sources and health claims. Environmental concerns and overfishing risks pressure companies to adopt sustainable sourcing, which can raise production costs in the near term.

Educating consumers on the distinctions between sources (fish vs. algae vs. krill) and the importance of standardized EPA/DHA content remains essential to combat misinformation and to reduce churn.

Go-to-Market and Commercial Strategies

Successful market entrants often combine clinical evidence with compelling consumer education campaigns that clarify dosage, source, and benefits. Multi-channel distribution—combining retail, pharmacy, healthcare practitioner channels, and DTC e-commerce—broadens reach. Co-branding with healthcare professionals and influencers in the wellness space increases credibility and discoverability.

Pricing tiers that offer value, mid-premium, and premium options target different consumer segments while subscription models boost lifetime value and retention.

Future Outlook and Opportunities

The future of the EPA and DHA Market is positive with multiple high-growth vectors: expansion of algae-derived supply, product fortification across mainstream food categories, personalized nutrition platforms that tailor omega-3 levels to individual biomarkers, and increased clinical adoption for specific therapeutic areas such as neurocognitive support and anti-inflammatory protocols.

Emerging economies offer untapped demand for preventive nutrition, while sustainability-driven innovations will likely shift long-term sourcing toward cultivated and bioengineered routes. Investors and incumbents that prioritize R&D, supply chain resilience, regulatory strategy, and consumer education are positioned to capture disproportionate market share.

Frequently Asked Questions (FAQs)

1. What is the EPA and DHA Market?

The EPA and DHA Market encompasses the production, formulation, and distribution of products containing the omega-3 fatty acids eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA), used in dietary supplements, fortified foods, infant nutrition, pharmaceuticals, and animal nutrition.

2. What are the primary sources of EPA and DHA?

Common sources include fish oil, krill oil, and algae oil. Fish oil is the most established source, while algae oil is a sustainable, vegan-friendly alternative gaining rapid adoption.

3. Which applications drive the most demand?

Dietary supplements remain the largest application, followed by infant nutrition, functional foods and beverages, and pharmaceutical applications for cardiovascular and anti-inflammatory therapies.

4. Which region is the largest market for EPA and DHA?

Asia Pacific is the largest and fastest-growing region, accounting for approximately 34.1% of the market share in 2024, supported by a large population base, rising incomes, and increasing health awareness.

5. What major trends will shape the market’s future?

Key trends include the rise of algae-based omega-3s, microencapsulation and emulsification for broader food applications, personalized nutrition, sustainability certifications and traceability, and increasing clinical evidence supporting targeted formulations.

Summary of Key Insights

The Global EPA and DHA Market is on a marked growth trajectory with projected expansion from USD 3,576.4 Million in 2024 to USD 9,463.0 Million by 2033 at a CAGR of 11.4%. Drivers include rising preventive health awareness, strong demand for infant nutrition fortified with DHA, expansion of functional foods, and technological advances in formulation and sustainable sourcing.

Asia Pacific leads the market with 34.1% share in 2024, while North America and Europe continue to exhibit robust demand driven by mature supplement markets and premiumization. Algae-derived EPA/DHA and delivery innovations represent significant growth opportunities, and companies that invest in traceability, clinical substantiation, and multi-channel distribution will be best positioned to capture market share. Overall, the outlook is favorable as omega-3s become a mainstream component of global nutritional strategies.

Purchase the report for comprehensive details : https://dimensionmarketresearch.com/checkout/epa-and-dha-market/