Market Overview:

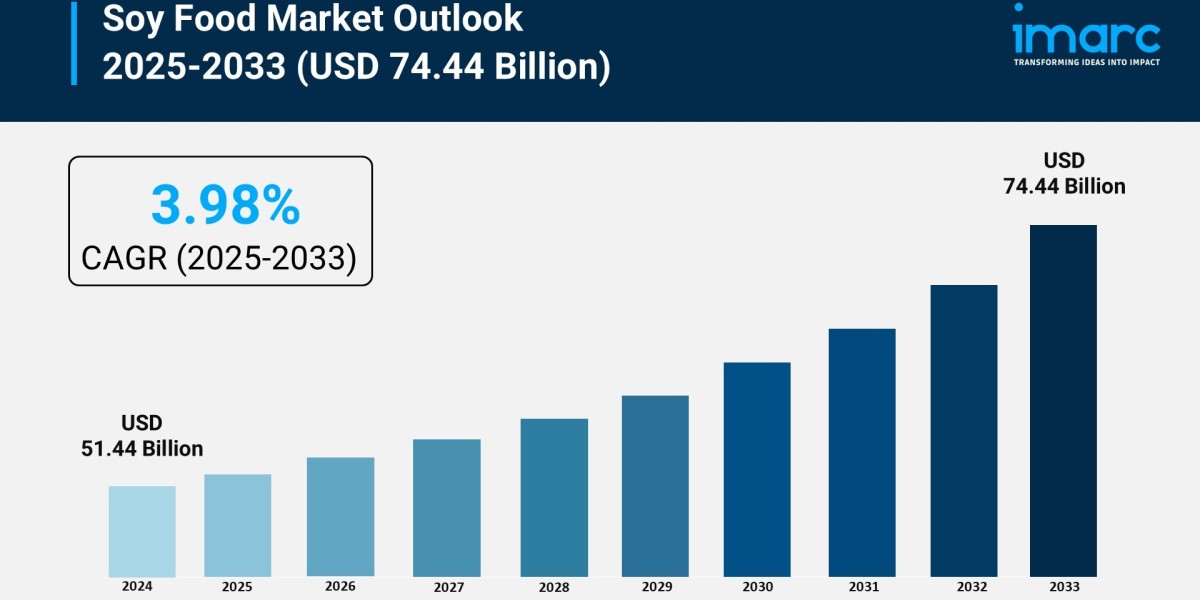

The soy food market is experiencing rapid growth, driven by expanding consumer demand for plant-based protein, increasing awareness of health and wellness benefits, and innovation in processing and product versatility. According to IMARC Group's latest research publication, "Soy Food Market Size, Share, Trends and Forecast by Product Type, Category, Distribution Channel, End-Use, and Region, 2025-2033", The global soy food market size was valued at USD 51.44 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 74.44 Billion by 2033, exhibiting a CAGR of 3.98% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/soy-food-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Soy Food Market

- Expanding Consumer Demand for Plant-Based Protein

The primary driver is the accelerating consumer shift toward plant-forward diets, encompassing vegan, vegetarian, and flexitarian lifestyles. Soy is highly valued as a complete protein source, containing all nine essential amino acids, making it a critical ingredient for consumers looking to reduce meat consumption for ethical, environmental, or health reasons. This preference is particularly strong in developed regions like North America and Europe, where market reports indicate that meat substitutes currently account for approximately 38% of the soy-based food market share. This high percentage underscores soy's foundational role in the growing plant-based protein category, driving continuous product innovation from leading food manufacturers to meet the expanding demand for alternatives like soy-based burgers, sausages, and chicken substitutes.

- Increasing Awareness of Health and Wellness Benefits

Growing global health consciousness significantly fuels the demand for soy foods, which are inherently low in cholesterol and rich in beneficial compounds. Soy products are widely recognized for their potential to support cardiovascular health; for instance, the inclusion of soy isoflavones is often highlighted in functional foods designed for optimal aging and condition-specific nutrition. Furthermore, the high global prevalence of lactose intolerance, particularly in Asia-Pacific which holds a substantial share of the market, drives the adoption of soy milk as a primary dairy alternative. Consequently, major food and beverage manufacturers are increasingly fortifying soy-based products, with this demand for functional and fortified foods being a key market driver in urban areas across North America, Europe, and Asia.

- Innovation in Processing and Product Versatility

Advancements in food processing technologies are overcoming traditional barriers to consumer acceptance, such as the undesirable 'beany' flavor and texture issues. Continuous innovation by ingredient suppliers and food companies is leading to next-generation soy protein isolates that offer improved solubility, neutral taste, and superior mouthfeel, significantly expanding soy's application. This has facilitated the use of soy-derived ingredients, such as soy protein and soy lecithin, in diverse products from high-protein bakery goods and confectionery to specialized sports nutrition formulations. This versatility allows manufacturers to meet the growing consumer preference for nutrient-dense, high-protein options, thereby driving the adoption of soy ingredients across nearly all food categories, especially in the fast-growing online retail channel.

Key Trends in the Soy Food Market

- Clean-Label, Non-GMO, and Organic Soy Products

A prominent emerging trend is the strong consumer preference for soy foods with "clean-label" attributes, specifically demanding non-genetically modified organism (non-GMO) and organic certification. Consumers are increasingly scrutinizing product labels due to concerns about sustainability, environmental impact, and ingredient origins, creating a premium segment in the market. Although a substantial majority of the global soybean market comprises genetically modified varieties, the non-GMO soy segment is projected to exhibit robust growth, indicating a shift in consumer purchasing power. This is spurring new product development, such as a prominent non-GMO food company recently releasing a line of organic edamame snacks and tofu, positioning the products on transparency and traceability to capture this health-conscious and ethical-sourcing consumer base.

- Functional Soy for Condition-Specific Nutrition

The market is moving beyond simple protein replacement to develop functional soy foods tailored for specific health conditions, a trend known as condition-specific nutrition. This is particularly relevant as consumers increasingly use diet to manage wellness goals, including weight management and healthy aging. Soy's high-quality, complete protein is being leveraged in nutrient-dense, smaller-portion meals and snacks, catering to individuals focused on satiety and muscle retention. For example, a significant global food company recently introduced a series of soy-based snack bars fortified with extra fiber and isoflavones, specifically marketed for consumers seeking digestive health support and benefits associated with hormonal balance, illustrating the transition of soy from a basic commodity to a specialized functional food ingredient.

- Expansion of Traditional and Asian Soy Foods in Western Markets

While soy milk and meat alternatives have been established in Western markets, there is an accelerating trend in the mainstream adoption of traditional Asian soy foods, driven by cultural exchange and a desire for diverse, whole-food plant protein sources. Products like tofu, tempeh, and natto are gaining significant traction, particularly with their traditional and fermented varieties being recognized for their gut health benefits. Tofu, in particular, is noted as one of the fastest-growing product categories in the global soy food market, reflecting its versatility and appeal to both vegetarian and non-vegetarian consumers. This trend is further supported by innovations like the introduction of convenient, grab-and-go snack-sized tofu bars in flavors designed for the Western palate, making these historically Asian staples accessible and exciting for a new generation of global consumers.

Our comprehensive soy food market outlook reflects both short-term tactical and long-term strategic planning. This analysis is essential for stakeholders aiming to navigate the complexities of the soy food market and capitalize on emerging opportunities.

Leading Companies Operating in the Global Soy Food Industry:

- Blue Diamond Growers

- Dean Foods

- Earth's Own Food Company

- Eden Foods

- Freedom Foods Group

- Harvest Innovations

- House Foods America Holding

- Archer Daniels Midland

- Miracle Soybean Food International Corp

- Cargill

- Nordic Soya Oy

- Victoria Group

- Hain Celestial

- Adisoy Foods & Beverages Pvt. Ltd.

Soy Food Market Report Segmentation:

By Product Type:

- Textured Vegetable Protein (TVP)

- Soy Milk

- Soy Oil

- Tofu

- Others

Tofu accounts for the majority of shares (32.2%) on account of its versatility, high protein content, and widespread acceptance across various cuisines.

By Category:

- Organic

- Conventional

Conventional dominates the market (77.6%) due to affordability, widespread consumer acceptance, and large-scale production capabilities.

By Distribution Channel:

- Supermarkets and Hypermarkets

- Departmental Stores

- Convenience Stores

- Online

- Others

Supermarkets and Hypermarkets represent the largest segment (42.8%) due to extensive product variety and competitive pricing.

By End-Use:

- Dairy Alternatives

- Meat Alternatives

- Bakery and Confectionary

- Functional Foods

- Infant Nutrition

- Others

Bakery and Confectionary dominates due to growing demand for high-protein, plant-based ingredients in baked goods.

Regional Insights:

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- North America (United States, Canada)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position owing to high soy consumption, strong plant-based dietary traditions, and expanding food processing industries.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302