Market Overview:

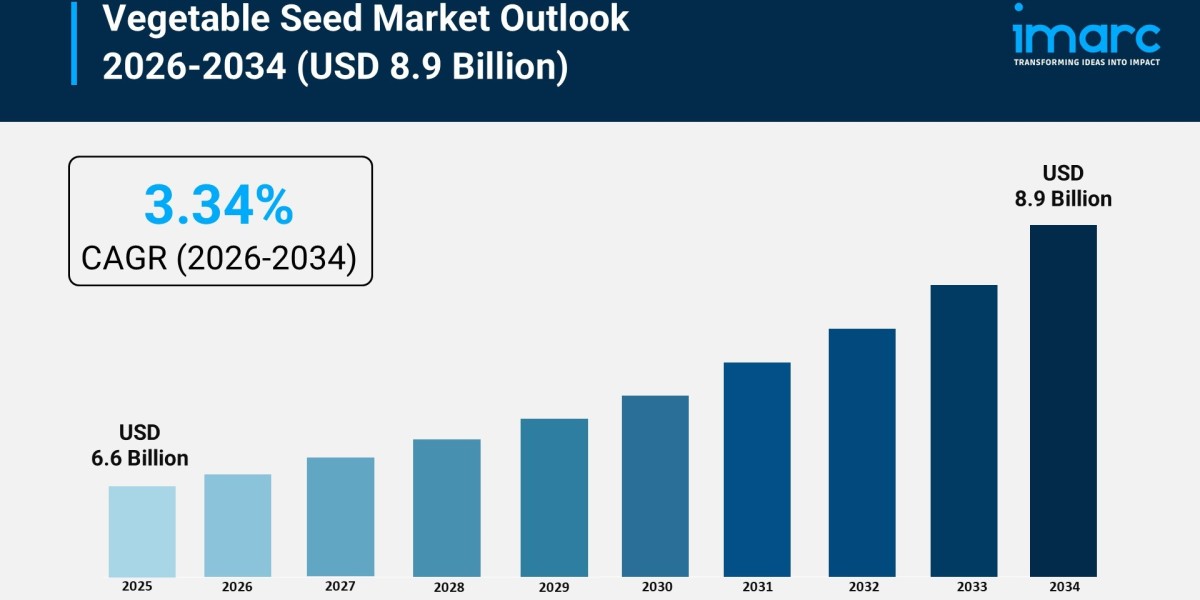

The vegetable seed market is experiencing rapid growth, driven by increasing adoption of high-yielding hybrid varieties, expansion of protected cultivation and greenhouse infrastructure, and global government initiatives for agricultural modernization. According to IMARC Group’s latest research publication, “Vegetable Seed Market Size, Share, Trends and Forecast by Type, Crop Type, Cultivation Method, Seed Type, and Region, 2026-2034”, The global vegetable seed market size was valued at USD 6.6Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 8.9 Billion by 2034, exhibiting a CAGR of 3.34% from 2026-2034.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/vegetable-seed-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Vegetable Seed Market

- Increasing Adoption of High-Yielding Hybrid Varieties

The transition from traditional, farmer-saved seeds to commercially produced hybrid varieties is a primary engine of growth for the global market. These hybrids offer uniform yields, enhanced disease resistance, and better physiological stability, which are essential for modern mechanized farming. In 2025, hybrid seeds account for approximately 80.7% of global sales, as commercial growers prioritize consistency to meet strict retail standards. For instance, hybrid tomato seeds have achieved a replacement rate of nearly 99.32% in advanced markets due to their superior vigor and shelf life. Leading companies like Bayer AG and Syngenta have intensified their focus on "precision breeding," utilizing doubled-haploid technology and marker-assisted selection to shorten development cycles. This widespread adoption is particularly evident in emerging economies like India and Brazil, where demonstration plots have shown yield gains of 20% to 40% over traditional open-pollinated varieties.

- Expansion of Protected Cultivation and Greenhouse Infrastructure

Rapid urbanization and increasing water scarcity are driving a global pivot toward protected cultivation, such as greenhouses and vertical farms. This shift creates a specialized demand for vegetable seeds specifically bred for controlled environments, where factors like light, humidity, and temperature are optimized. In 2025, while open-field systems still hold the majority of the market share, the protected cultivation segment is expanding at a rate nearly 30% faster than traditional methods. Government initiatives are playing a critical role; for example, Saudi Arabia’s Vision 2030 has allocated SAR 10.5 billion (USD 2.8 billion) to expand greenhouse infrastructure to achieve 70% vegetable self-sufficiency. Consequently, seed companies are developing "low-light" and "compact-growth" cultivars for leafy greens and Solanaceae crops. This trend ensures year-round production, insulating farmers from the erratic weather patterns that frequently cause up to 15% annual fluctuations in open-field seed production.

- Global Government Initiatives for Agricultural Modernization

Strategic government support and favorable policy frameworks are significantly boosting the availability and adoption of certified seeds. In early 2025, the Indian government announced the National Mission on High Yielding Seeds as part of its Union Budget, allocating INR 100 Crore to strengthen the research ecosystem and propagate climate-resilient varieties. These initiatives are mirrored globally; for example, the USDA’s Animal and Plant Health Inspection Service cleared twelve gene-edited vegetables for commercial planting in late 2024, providing a clear regulatory pathway for innovation. Furthermore, in Egypt, BASF Agricultural Solutions launched commercial operations under the Nunhems brand in May 2025 to support the national goal of increasing agricultural exports. Such programs reduce the financial risk for smallholder farmers, who make up a substantial portion of the agricultural base in developing regions, by underwriting the cost of premium seeds and providing essential agronomic support.

Key Trends in the Vegetable Seed Market

- Integration of Gene-Editing and CRISPR Technologies

A transformative trend in the industry is the use of CRISPR-Cas9 and other gene-editing tools to develop "climate-ready" vegetables with enhanced nutritional profiles. Unlike traditional GMOs, these non-transgenic edits allow for precise modifications that improve traits like heat tolerance and drought resistance. In 2025, Japan has already successfully commercialized gamma-aminobutyric acid (GABA)-rich tomatoes, while the European Union is currently proposing smoother regulatory pathways for gene-edited crops. Major players like Rijk Zwaan recently launched heat-tolerant lettuce varieties specifically designed to maintain yield consistency despite rising global temperatures. These technological advancements enable breeders to deliver resilient seeds in roughly half the time of conventional breeding. By focusing on specific consumer benefits, such as improved flavor or higher vitamin content, seed companies are creating high-value niche markets that command premium prices compared to standard commodity hybrids.

- Digital Traceability and E-Commerce Seed Portals

The digitalization of the seed supply chain is gaining massive traction, particularly to combat the prevalence of counterfeit products, which currently affect an estimated 15% to 20% of the market in certain regions. In 2025, the growth of e-commerce seed portals has bridged the gap between global breeders and farmers in tier-2 and tier-3 towns. Digital platforms now offer integrated QR-code traceability, allowing growers to verify the authenticity and quality of their seeds via smartphone. For example, Syngenta has expanded its digital agriculture platforms to provide data-driven planting recommendations alongside seed purchases. This trend is not only increasing market transparency but also democratizing access to high-quality germplasm for smallholders. Furthermore, these platforms act as hubs for agronomic advice, helping farmers optimize their inputs and improve overall productivity by providing real-time information on soil health and local weather forecasts.

- Demand for Bio-Primed and Sustainable Seed Treatments

Environmental regulations and a growing consumer preference for residue-free produce have led to a surge in bio-primed seeds. This trend involves coating seeds with microbial inoculants, bio-stimulants, or protective layers that improve germination and nutrient uptake without the use of synthetic chemicals. In January 2025, Gowan SeedTech LLC acquired a major vegetable seed treatment platform in the United States, signaling a shift toward specialized, environmentally friendly protection technologies. These advanced coatings ensure better crop establishment and reduce the need for subsequent pesticide applications, aligning with global sustainability goals. Additionally, companies like Enza Zaden have recently inaugurated state-of-the-art R&D facilities dedicated to breeding resilient varieties that thrive with fewer chemical inputs. This movement toward "biologicals" is particularly strong in the organic segment, where farmers are willing to pay a premium for seeds that are pre-optimized for organic soil conditions.

We explore the factors propelling the vegetable seed market growth, including technological advancements, consumer behaviors, and regulatory changes.

Leading Companies Operating in the Global Vegetable Seed Industry:

- American Takii Inc.

- BASF SE

- Bayer CropScience AG

- Bejo Zaden BV

- East-West Seed

- Enza Zaden Beheer B.V.

- Groupe Limagrain

- Namdhari Seeds Pvt. Ltd.

- Rijk Zwaan Zaadteelt En Zaadhandel BV

- Sakata Seed Corporation

- Syngenta AG (Cnac Saturn (Nl) B.V.)

- UPL Limited

Vegetable Seed Market Report Segmentation:

By Type:

- Open Pollinated Varieties

- Hybrid

Open pollinated varieties dominate the market with a 68.7% share in 2024 due to their cost-effectiveness, adaptability, and suitability for organic farming, enabling farmers to save seeds and maintain genetic diversity.

By Crop Type:

- Solanaceae

- Root & Bulb

- Cucurbit

- Brassica

- Leafy

- Others

The Solanaceae segment leads the vegetable seed market with a 41.7% share in 2024, driven by high demand for versatile crops like tomatoes and peppers, which are rich in nutrients and economically significant for growers.

By Cultivation Method:

- Protected

- Open Field

Open field cultivation holds the largest market share due to its cost-effectiveness, scalability, and ability to support a wide range of vegetable crops while integrating sustainable practices that enhance soil health.

By Seed Type:

- Conventional

- Genetically Modified Seeds

Conventional seeds account for the majority of the market, favored for their natural breeding methods, affordability, and adaptability, making them a reliable choice for diverse agricultural needs.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific leads the vegetable seed market with a 47.7% share in 2024, driven by extensive agricultural activities, government support for sustainable practices, and investments in advanced seed technologies.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302