Market Overview:

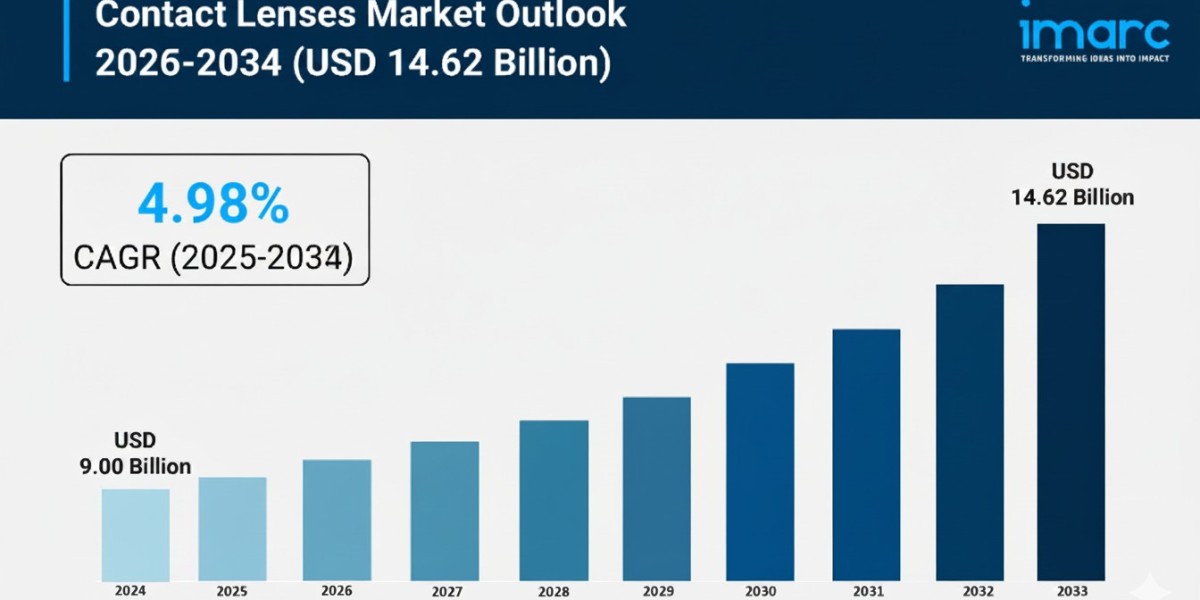

The contact lenses market is experiencing rapid growth, driven by increasing global prevalence of refractive errors, expansion of the pediatric myopia management segment, and rapid growth of e-commerce and subscription models. According to IMARC Group's latest research publication, "Contact Lenses Market Size, Share, Trends and Forecast by Material, Design, Usage, Application, Distribution Channel, and Region, 2026-2034", The global contact lenses market size was valued at USD 9.00 Billion in 2025. The market is projected to reach USD 14.62 Billion by 2034, exhibiting a CAGR of 4.98% from 2026-2034.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/contact-lenses-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Contact Lenses Market

- Increasing Global Prevalence of Refractive Errors

The primary driver for the contact lenses market is the significant surge in refractive vision disorders, particularly myopia, hyperopia, and astigmatism. Recent data from the World Health Organization indicates that approximately 2.2 billion people globally live with near or distant vision impairment, a figure that is rising as digital lifestyles become the norm. In 2025, screen-heavy work and educational environments have led to a "myopia epidemic," especially in urbanized regions like East Asia and North America. In the United States alone, industry reports from organizations like CooperVision highlight that there are now approximately 45 million active lens wearers. This massive patient base creates a sustained demand for corrective lenses. Furthermore, as diagnostic tools become more accessible in developing economies, millions of previously undiagnosed individuals are entering the market, seeking the convenience and expanded field of view that contact lenses offer over traditional eyeglasses.

- Expansion of the Pediatric Myopia Management Segment

A major shift in the industry is the focus on early intervention for children as young as six years old to slow the progression of nearsightedness. In 2025, regulatory bodies in several major markets have lowered the age barriers for therapeutic contact lenses, effectively expanding the addressable market for pediatric eye care. For instance, in August 2025, CooperVision achieved a significant regulatory milestone in Japan, a country with one of the world's highest myopia rates, to market soft contact lenses specifically for myopia management in children. This clinical focus is supported by studies showing that specialized lenses, such as orthokeratology or multifocal soft lenses, can reduce axial eye elongation by a significant margin compared to standard spectacles. As parents increasingly prioritize long-term ocular health to prevent future complications like retinal detachment, the pediatric segment has become a multi-billion dollar pillar of the broader vision care industry.

- Rapid Growth of E-commerce and Subscription Models

The modernization of distribution channels has drastically increased consumer access to contact lenses, moving beyond traditional brick-and-mortar clinics. In 2025, digital retail platforms and subscription-based models are revolutionizing how users purchase and replenish their supplies. According to a Vision Council report from April 2025, online sales of contact lenses climbed to 39% of the total market share in the first quarter of the year, up from 35% just a few months prior. This trend is further fueled by legislative changes, such as the relaxation of teleoptometry laws in several regions, which now allow for digital prescription renewals. Companies like Lenskart have expanded their reach to cover over 27,500 postal codes, while others use AI-driven virtual try-on tools and personalized reminders to drive repeat purchases. These digital-first strategies cater to younger, tech-savvy demographics who value the convenience of doorstep delivery and transparent pricing.

Key Trends in the Contact Lenses Market

- Integration of Smart Technology and Augmented Reality

The most futuristic trend in the market involves transforming contact lenses into "smart" wearable devices capable of displaying digital information or monitoring health. In 2025, the industry has moved past the experimental phase, with companies like XPANCEO raising 250 million dollars in July to develop AI-powered lenses that integrate extended reality and night vision. These devices aim to create a screenless future by projecting notifications or navigation data directly onto the user's field of vision. Additionally, smart lenses are being utilized for medical diagnostics, such as monitoring intraocular pressure for glaucoma patients or tracking glucose levels in tear fluid for diabetics. This integration of microelectronics and moisture-resistant sensors allows the contact lens to serve as a 24/7 health hub, bridging the gap between traditional optometry and the broader Internet of Things ecosystem, offering users a level of functional utility far beyond simple sight correction.

- Advancements in Bio-Compatible and Moisture-Locking Materials

A major trend focused on user comfort is the widespread adoption of next-generation silicone hydrogel and specialized surface technologies. In 2025, manufacturers are launching products like Alcon’s Precision1 lenses, which feature Smartsurface technology that maintains over 80% water content on the lens surface. This innovation is a direct response to the rise of "digital eye strain," where users experience dryness due to prolonged computer use. These advanced materials provide superior oxygen permeability, allowing for up to 16 hours of comfortable wear. Furthermore, the market is seeing a massive shift toward daily disposables, which are preferred for their hygiene and lack of maintenance. Recent reports indicate that the soft lens segment now accounts for over 72% of the global market value, as consumers prioritize high-performance materials that mimic the natural environment of the eye to prevent irritation and infection during long workdays.

- Specialized Therapeutic and Drug-Delivering Lenses

Contact lenses are increasingly being used as sophisticated delivery systems for ocular medications, moving the product from a corrective tool to a therapeutic device. In 2025, a standout trend is the development of 3D-printed medicated lenses that release antihistamines or glaucoma treatments gradually throughout the day. For example, Johnson & Johnson has successfully introduced lenses pre-loaded with ketotifen to provide continuous relief for allergy sufferers, eliminating the need for frequent eye drops. Similarly, researchers have developed "theranostic" lenses that can both sense elevated eye pressure and automatically release the necessary medication in response. This trend addresses the common issue of patient non-compliance with traditional drop regimens, which affects approximately six out of ten glaucoma patients. By embedding therapeutic agents directly into the lens matrix, the industry is setting a new standard for integrated eye care that combines vision correction with proactive disease management.

We explore the factors propelling the contact lenses market growth, including technological advancements, consumer behaviors, and regulatory changes.

Leading Companies Operating in the Global Contact Lenses Industry:

- Alton Vision LLC

- Bausch & Lomb Incorporated

- Carl Zeiss AG

- Contamac Holdings Limited

- EssilorLuxottica SA

- Hoya Corporation

- Johnson & Johnson Services, Inc.

- Menicon Co. Limited

- SEED Co. Limited

- SynergEyes Inc.

- Cooper Companies Inc.

Contact Lenses Market Report Segmentation:

By Material:

- Gas Permeable

- Silicone Hydrogel

- Hybrid

- Others

In 2024, silicone hydrogel lenses dominate the market with 87.8% share due to superior oxygen permeability, comfort, biocompatibility, and compatibility with various prescriptions.

By Design:

- Spherical

- Toric

- Multifocal

- Others

Spherical lenses lead the design segment with 60.5% market share in 2024, favored for their effectiveness in correcting common refractive errors and ease of availability.

By Usage:

- Daily Disposable

- Disposable

- Frequently Replacement

- Traditional

Daily disposable lenses account for 33.2% of the market in 2024, driven by consumer demand for hygiene, convenience, and lower complication rates.

By Application:

- Corrective

- Therapeutic

- Cosmetic

- Prosthetic

- Lifestyle-oriented

Corrective lenses dominate with 45.0% market share in 2024, addressing the rising prevalence of refractive errors and enhancing vision correction options.

By Distribution Channel:

- E-Commerce

- Eye Care Practitioners

- Retail Stores

Retail stores lead with a 45.8% share in 2024, benefiting from consumer trust in personalized services and immediate product availability.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America leads the contact lenses market in 2024 with a 38.0% share, supported by advanced healthcare, high vision care awareness, easy access to optometric services, and a large population needing corrective lenses.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302